In cryptocurrency trading, moving averages are among the most fundamental and important technical indicators. However, traditional Simple Moving Average (SMA) and Exponential Moving Average (EMA) face difficulties in simultaneously satisfying the conflicting requirements of lag reduction and noise filtering. The Arnaud Legoux Moving Average (ALMA) was developed to solve this problem.

For those who want to learn more about detailed Pine Script features, please check TradingView's Pine Script Official Reference.

ALMA is an innovative moving average developed in 2009 by Arnaud Legoux, Dimitrios Kouzis-Loukas, and Anthony Laicz. This indicator, also provided as standard on TradingView, achieves the optimal balance between responsiveness and smoothing that traditional moving averages couldn't realize by using Gaussian distribution-based weighting.

ALMA's Innovative Calculation Principles and Mathematical Foundation

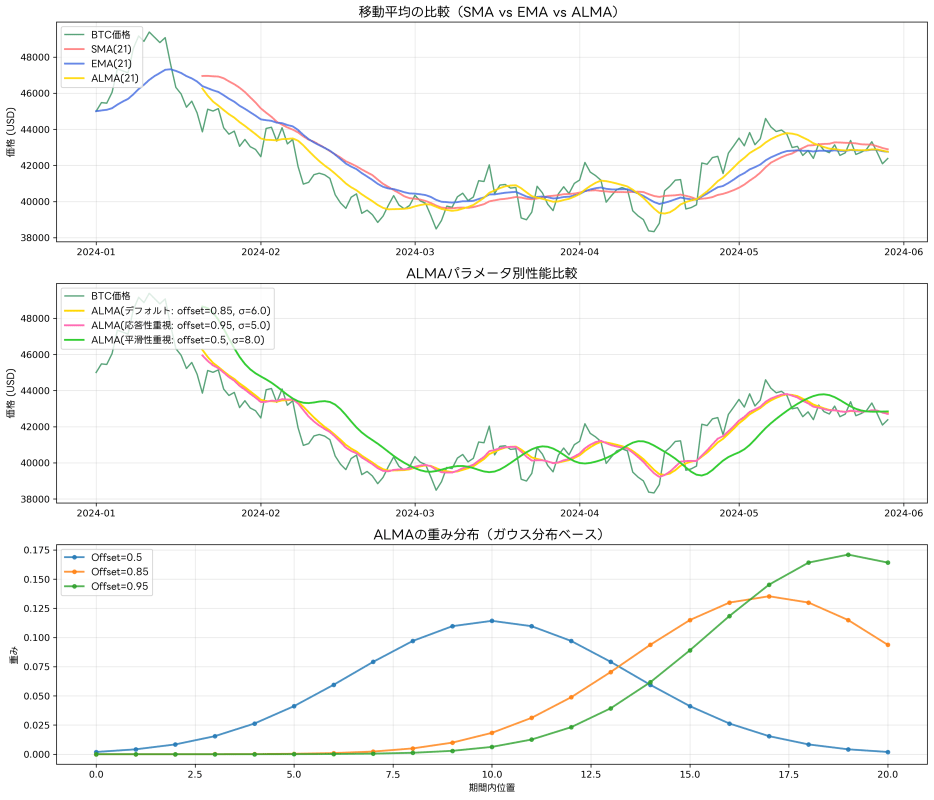

ALMA's greatest characteristic is applying Gaussian distribution-based weighting to each data point. Traditional moving averages used simple methods of either giving equal weight to all data within the period (SMA) or giving greater weight to the most recent data (EMA). However, ALMA uses a mathematically optimized weighting function to effectively remove noise while maintaining responsiveness to price movements.

ALMA calculation involves three important parameters. First is Period, which determines the number of data points used in calculation. Second is Offset, which adjusts the center position of the Gaussian distribution. This typically takes values from 0 to 1, with 0.85 set as the default value. Third is Sigma, which controls the spread of the Gaussian distribution. The default value is 6.0, but adjusting this value allows changing the smoothing level.

Through combinations of these parameters, ALMA can be flexibly customized according to market characteristics and trading styles. Increasing the Offset value creates a highly responsive moving average that emphasizes more recent data, while decreasing it creates a stable moving average that emphasizes more historical data.

Special Effectiveness of ALMA in Cryptocurrency Markets

Cryptocurrency markets have characteristics of high volatility and 24-hour continuous trading compared to traditional financial markets. In such environments, extracting true trends from noisy price movements becomes particularly important. ALMA's Gaussian distribution-based weighting demonstrates its true value in such noisy environments.

Applying ALMA to TradingView's BTCUSD chart shows that subtle trend changes that were difficult to capture with traditional moving averages can be clearly identified. Particularly for major cryptocurrencies like Bitcoin and Ethereum, the high-precision trend analysis provided by ALMA can significantly improve entry and exit timing.

Additionally, while cryptocurrency markets frequently experience dramatic price movements in short periods, ALMA's smoothing function enables grasping fundamental trend direction without being misled by these temporary price fluctuations. This is extremely important for avoiding emotional trading decisions and realizing more objective and disciplined trading approaches.

Performance Optimization Through Parameter Adjustment

Proper parameter adjustment is essential for unleashing ALMA's true power. Period setting depends on the timeframe to be analyzed and market characteristics. Short-term trading commonly uses 14 to 21 periods, medium-term trading uses 50 to 100 periods, and long-term analysis uses 200 periods or more.

Offset adjustment is determined by whether to emphasize trend-following strategies or reversal strategies. Setting offset values to 0.85 or higher increases responsiveness to price movements, making it suitable for early trend detection. Meanwhile, the range of 0.5 to 0.8 provides more stable signals, leading to reduced false signals.

Sigma value adjustment is performed according to market volatility. In high-volatility markets, setting within the range of 6.0 to 8.0 can effectively remove noise. Conversely, in stable markets, setting within the range of 4.0 to 6.0 enables more sensitive detection of price movements.

ALMA Implementation and Customization with Pine Script

TradingView's Pine Script allows for unique customizations in addition to basic ALMA implementation. Below is an implementation example of ALMA with multi-timeframe support and alert functionality.

//@version=5

indicator("Custom ALMA", shorttitle="Custom ALMA", overlay=true)

// Parameter settings

length = input.int(21, title="Period", minval=1)

offset = input.float(0.85, title="Offset", minval=0, maxval=1, step=0.01)

sigma = input.float(6.0, title="Sigma", minval=0.1, step=0.1)

// Multi-timeframe settings

higher_tf = input.timeframe("1D", title="Higher Timeframe")

use_higher_tf = input.bool(false, title="Use Higher Timeframe")

// ALMA calculation

alma_current = ta.alma(close, length, offset, sigma)

alma_higher = request.security(syminfo.tickerid, higher_tf, ta.alma(close, length, offset, sigma))

alma_final = use_higher_tf ? alma_higher : alma_current

// Trend direction determination

trend_up = alma_final > alma_final[1]

trend_color = trend_up ? color.green : color.red

// Plotting

plot(alma_final, title="ALMA", color=trend_color, linewidth=2)

// Entry signals

long_signal = ta.crossover(close, alma_final) and trend_up

short_signal = ta.crossunder(close, alma_final) and not trend_up

// Signal display

plotshape(long_signal, title="Long Signal", style=shape.triangleup,

location=location.belowbar, color=color.green, size=size.small)

plotshape(short_signal, title="Short Signal", style=shape.triangledown,

location=location.abovebar, color=color.red, size=size.small)

// Alerts

alertcondition(long_signal, title="ALMA Long Signal", message="ALMA Buy Signal")

alertcondition(short_signal, title="ALMA Short Signal", message="ALMA Sell Signal")

This script implements visual trend direction display and crossover signal detection functions in addition to basic ALMA calculation. Using the Pine Script Editor enables implementation of even more complex strategies.

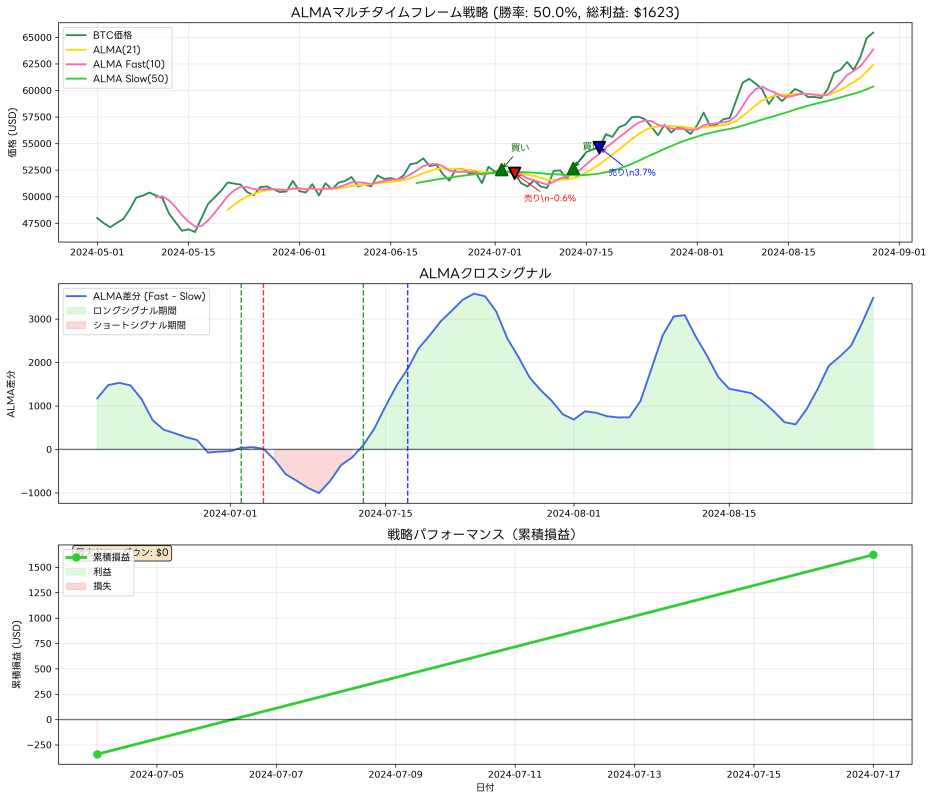

ALMA Application Strategies in Trend Analysis

The most effective approach for utilizing ALMA in trend analysis is combining analysis across multiple timeframes. Through hierarchical analysis methods that confirm long-term trends on daily charts and adjust entry timing on 4-hour or 1-hour charts, more precise trading decisions become possible.

For uptrend confirmation, it's important that ALMA shows an upward-sloping tendency and prices are positioned above ALMA. Furthermore, overlaying multiple period ALMAs enables confirmation of short-term, medium-term, and long-term trend consistency. When ALMAs of all periods show the same direction, the reliability of that trend improves significantly.

ALMA is also effective in divergence detection. When prices are making new highs while ALMA's slope is moderating, there's a possibility that trend momentum is weakening. Such early warning signals enable executing position adjustments and risk management reinforcement at appropriate timing.

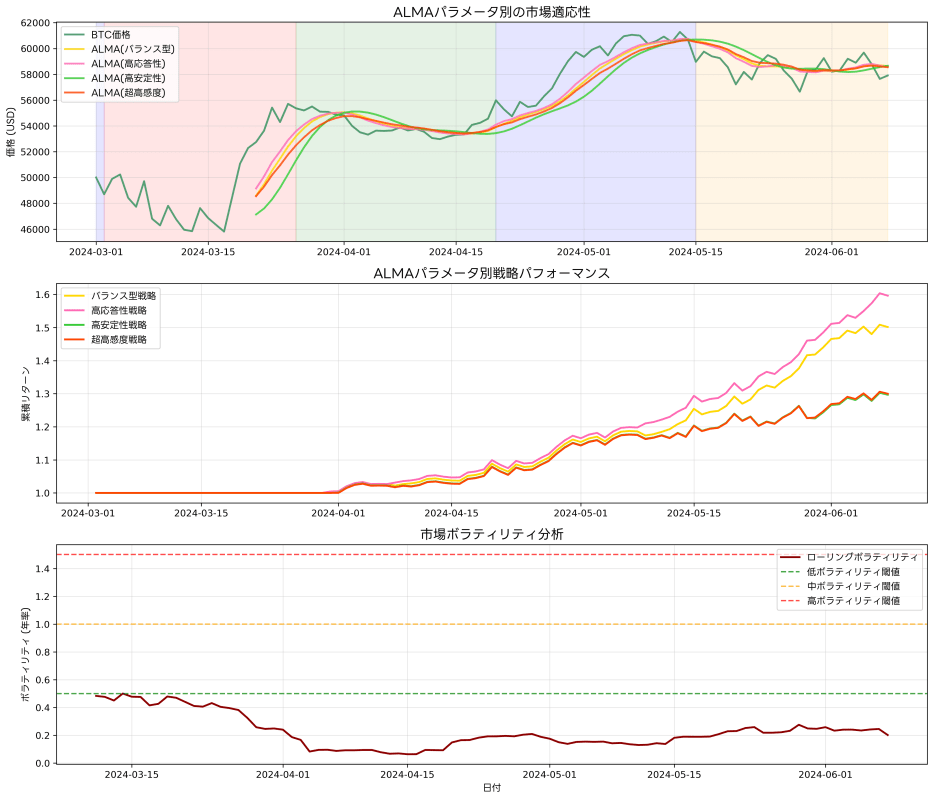

Development of Volatility-Adaptive ALMA

To respond to the characteristic high volatility of cryptocurrency markets, developing adaptive systems that dynamically adjust ALMA parameters according to market volatility is effective. By combining with ATR (Average True Range) and Bollinger Bands, optimized ALMA settings for current market conditions can be automatically selected.

During high-volatility periods, increasing Sigma values strengthens noise filtering, while during low-volatility periods, enhancing sensitivity enables optimal performance in all market environments. Such adaptive approaches, combined with TradingView's alert features, also enable construction of automated trading systems for 24-hour markets.

Risk Management and Position Sizing

In trading strategies using ALMA, appropriate risk management becomes the key to success. Using the distance from ALMA to price as a stop-loss reference enables avoiding large losses while responding to natural market fluctuations. Generally, setting stop-loss positions at 1.5 to 2 times ATR distance from ALMA is recommended.

In position sizing, referencing ALMA's slope and degree of price divergence enables more precise risk adjustment. When ALMA's slope is steep, it indicates strong trend momentum, allowing consideration of larger positions than usual. Conversely, when the slope is gentle, a cautious approach is necessary.

Integration Strategies with Other Technical Indicators

Integrated utilization with other technical indicators is important for maximizing ALMA's effectiveness. Combining with RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) enables more accurate judgment of trend strength and sustainability.

TradingView's indicator library publishes numerous ALMA-based composite indicators, enabling finding optimal combinations according to individual trading styles. Particularly, the combination of ALMA and Ichimoku Cloud provides an extremely powerful analytical framework through fusion with Japanese-originated technical analysis methods.

Backtesting and Optimization

Comprehensive backtesting is essential for verifying the effectiveness of ALMA-based trading strategies. Evaluating performance in different market environments and optimizing parameters can significantly improve success probability in actual trading.

Using TradingView's Strategy Tester enables testing ALMA-based strategies across various cryptocurrency pairs and timeframes. Particularly important metrics are win rate, profit ratio, maximum drawdown, and Sharpe ratio.

Psychological Factors and ALMA's Objectivity

In cryptocurrency trading, emotional decisions are often made due to rapid price movements. ALMA's mathematically optimized approach eliminates such psychological biases and supports objective trading decisions.

Particularly by suppressing emotional reactions like FOMO (Fear of Missing Out) and panic selling, and continuing disciplined trading following trends indicated by ALMA, long-term profitability can be improved.

Market Efficiency and ALMA's Advantage

According to the Efficient Market Hypothesis, all information is already incorporated into prices, but in actual markets, short-term inefficiencies exist due to information asymmetry and participants' cognitive biases. ALMA's advanced mathematical model enables detecting trend changes earlier than other participants by exploiting such market inefficiencies.

Fusion Possibilities with Machine Learning

With modern financial technology developments, developing advanced prediction systems combining ALMA with machine learning algorithms has become possible. Using features extracted from ALMA as input for machine learning models enables achieving more accurate price predictions and automation of optimal parameter selection.

Such approaches, combined with TradingView's advanced analytical features, also enable constructing AI-assisted trading systems.

Regulatory Environment and ALMA Application

ALMA-based analysis is also effective against changes in cryptocurrency regulatory environments in various countries. Even during rapid market movements due to regulatory announcements, ALMA's smoothing function enables distinguishing temporary panic from structural changes for analysis.

Continuous Learning and Improvement

Continuous learning and strategy improvement are important for effectively utilizing ALMA. By adjusting parameters according to market environment changes and regularly conducting verification with new market data, optimized states can always be maintained.

Additionally, learning new ALMA application methods and improvement techniques through information exchange with other traders and research of academic papers is valuable.

Conclusion

Arnaud Legoux Moving Average (ALMA) is an innovative technical indicator that overcomes the limitations of traditional moving averages. Through Gaussian distribution-based weighting, it realizes both noise removal and responsiveness, demonstrating excellent performance particularly in high-volatility cryptocurrency markets.

Through appropriate parameter adjustment and combination with other indicators, more precise trend analysis and trading decisions become possible. Through Pine Script customization and continuous optimization, constructing ALMA-based strategies optimized for individual trading styles can significantly improve cryptocurrency trading success probability.

ALMA's objective and mathematically supported approach eliminates emotional trading decisions and promotes more disciplined investment behavior. Through continuous learning and practice, maximize utilization of this powerful tool to realize stable profits in volatile cryptocurrency markets.

For those who wish to learn Pine Script programming more deeply, please utilize TradingView's Pine Script Official Reference.

Disclaimer

The design, implementation, operation of automated trading systems and related financial transactions should all be judged and executed at the user's own discretion and responsibility. The author and the publication medium (Qiita) assume no legal or financial responsibility for any damages or losses arising from these activities.

This article is intended to provide information based on the author's technical verification and operational experience with TradingView and Pine Script. While efforts have been made regarding the accuracy and completeness of the content, its validity and applicability are not guaranteed.

Since market trading inherently involves risks, it is recommended to conduct sufficient backtesting and risk assessment before actual capital investment, and to seek professional advice when necessary.

Please utilize this article after fully understanding and agreeing to the above matters.