In cryptocurrency trading, determining where to set the next price target is a crucial challenge faced by all traders. Target setting based on emotional judgment or unfounded speculation makes profit maximization difficult, let alone appropriate risk management. Auto Fib Extension is a powerful analytical method that improves this situation and enables precise price prediction based on mathematical foundations.

For those who want to learn more about detailed Pine Script features, please check TradingView's Pine Script Official Reference.

Fibonacci Extension applies the golden ratio concept discovered by 13th-century mathematician Leonardo Fibonacci to modern financial market analysis. This method is used to predict future price arrival points based on existing price movement patterns. Advanced chart analysis platforms like TradingView can automate these complex calculations and display them visually in real-time.

Mathematical Foundation and Market Psychology of Fibonacci Extensions

The reason Fibonacci Extensions are effective in market analysis is not merely mathematical beauty. Behind this method lies deep connections with human psychological tendencies and collective behavioral patterns of market participants. Since many traders execute trades while conscious of Fibonacci levels, orders naturally concentrate at these price zones, making price reversals and stagnation more likely to occur.

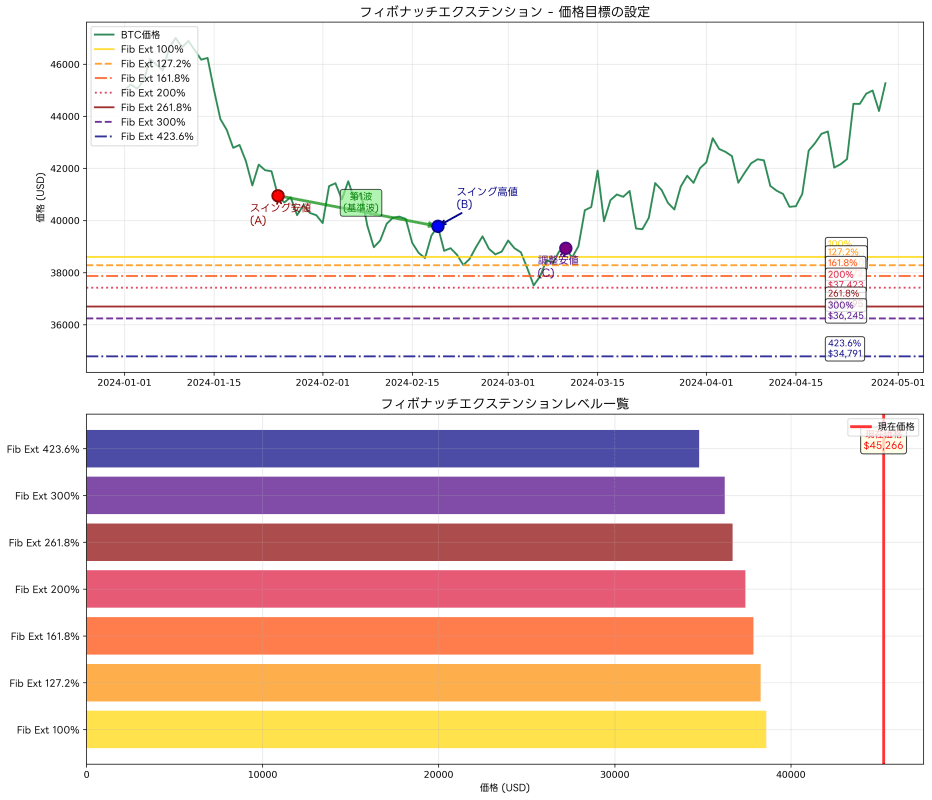

Basic Fibonacci Extension levels include 100%, 127.2%, 161.8%, 261.8%, etc. These values are derived from Fibonacci sequence ratios, with 161.8% (reciprocal of the golden ratio) and 261.8% particularly often observed functioning as powerful price targets. The 100% extension shows an extension of the same width as the initial price movement and is widely used as the most basic target price.

In cryptocurrency markets, due to higher volatility compared to traditional financial markets, price reactions at these Fibonacci levels tend to appear more prominently. For major cryptocurrencies like Bitcoin and Ethereum, Fibonacci Extension levels frequently function as powerful support or resistance at important trend reversal points.

Automated Benefits of Auto Fib Extension

Traditional manual Fibonacci Extension drawing methods are prone to subjectivity in reference point selection and line drawing, making it difficult to maintain analytical consistency. Auto Fib Extension solves these problems and enables objective, reproducible analysis. Since the system automatically identifies important highs and lows and calculates mathematically accurate Fibonacci levels, the influence of human error and subjective bias can be minimized.

On TradingView's BTCUSD chart, such automated Fibonacci Extensions can be confirmed in real-time, enabling constant awareness of target levels that dynamically update according to price movements. This allows rapid response to market changes and optimal entry and exit timing identification.

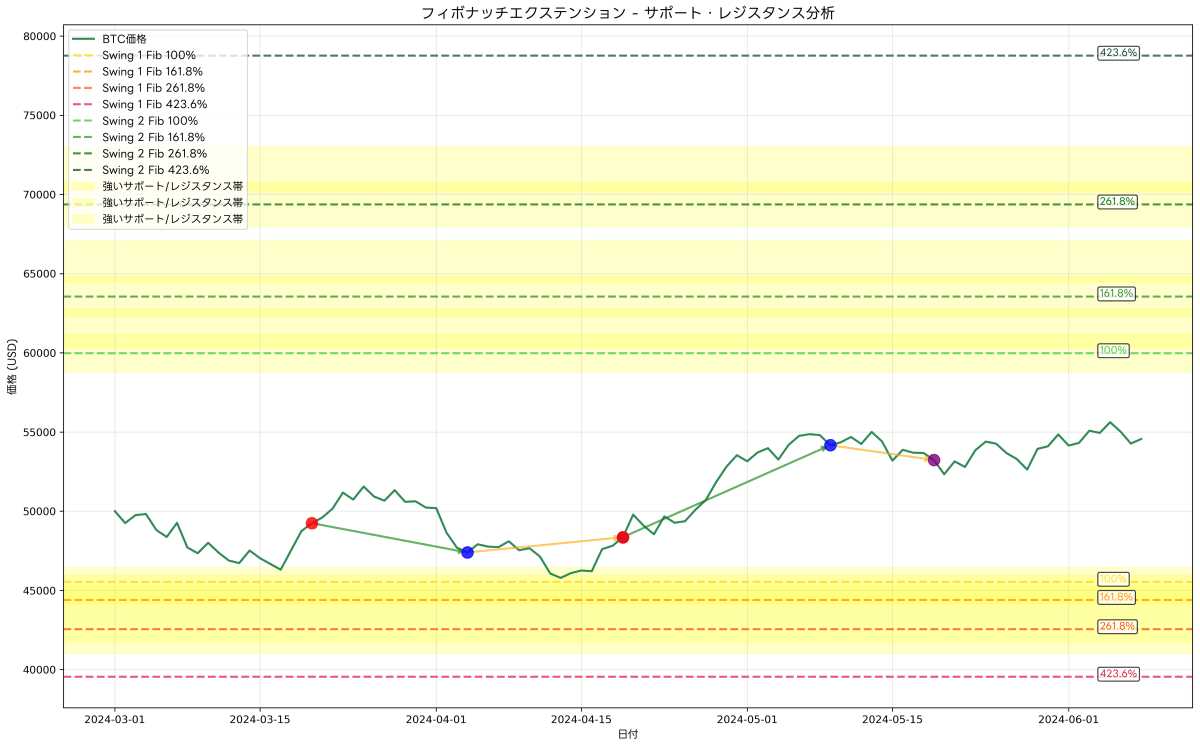

Another important automation advantage is easier simultaneous analysis across multiple timeframes. By simultaneously displaying Fibonacci Extensions on different timeframes (daily, 4-hour, 1-hour, etc.) and identifying overlapping price zones, more reliable price targets can be set.

Strategic Utilization in Price Target Setting

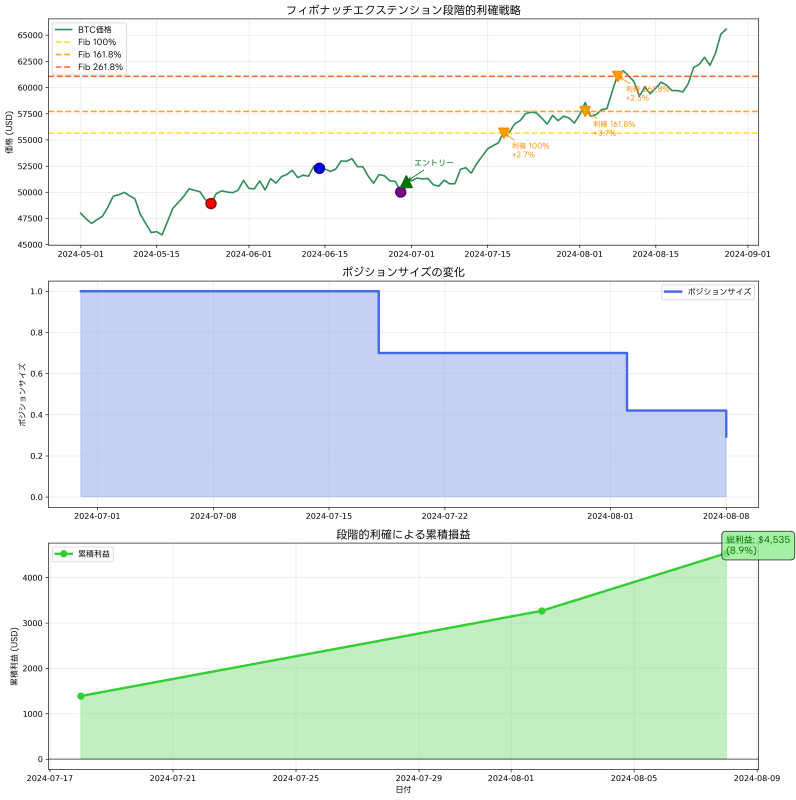

Price target setting using Auto Fib Extension requires establishing multiple targets in stages rather than adhering to single levels. For example, when strong uptrends occur, a staged approach is effective: partial profit-taking at 100% extension, additional profit-taking at 127.2%, main profit-taking at 161.8%, and setting 261.8% as the final target.

Such staged profit-taking strategies enable profit maximization while responding to market uncertainty. Additionally, observing price reactions at each Fibonacci level makes it possible to evaluate trend strength and sustainability. In strong trends, although temporary stagnation at Fibonacci levels may occur, prices tend to break through quickly.

Conversely, in weak trends or correction phases, strong resistance is received at Fibonacci levels, increasing the possibility of price reversals. By accurately understanding such market conditions, position adjustments and risk management optimization can be performed.

Utilizing Fibonacci Levels as Entry Points

Auto Fib Extension can be effectively utilized not only for price target setting but also for identifying new entry points. Particularly, strategies targeting price reversals at Fibonacci Extension levels when capturing pullback buying or retracement selling opportunities are effective. For example, during correction phases in uptrends, when prices decline to around 127.2% extension levels, buy entries targeting rebounds from there can be considered.

Using TradingView's Pine Script enables automating such entry conditions and, combined with alert functions, capturing trading opportunities in 24-hour cryptocurrency markets without missing them. Automated systems enable executing consistent trading strategies while eliminating emotional judgments.

Implementation and Customization with Pine Script

From basic Auto Fib Extension implementation to advanced customization, flexible analytical environments can be built using Pine Script. Below is an example script with basic automatic Fibonacci Extension drawing functionality:

//@version=5

indicator("Auto Fib Extension", shorttitle="Auto Fib Ext", overlay=true)

// Parameter settings

lookback = input.int(20, title="Search Period", minval=5, maxval=100)

show_levels = input.bool(true, title="Show Levels")

show_labels = input.bool(true, title="Show Labels")

// High/low detection

highest_price = ta.highest(high, lookback)

lowest_price = ta.lowest(low, lookback)

highest_index = ta.highestbars(high, lookback)

lowest_index = ta.lowestbars(low, lookback)

// Trend direction determination

trend_up = ta.rising(ta.sma(close, 20), 5)

// Fibonacci Extension calculation

if trend_up

swing_low = lowest_price

swing_high = highest_price

extension_100 = swing_high + (swing_high - swing_low)

extension_1272 = swing_high + (swing_high - swing_low) * 1.272

extension_1618 = swing_high + (swing_high - swing_low) * 1.618

extension_2618 = swing_high + (swing_high - swing_low) * 2.618

// Extension level drawing

if show_levels

line.new(bar_index + highest_index, extension_100, bar_index, extension_100,

color=color.blue, width=2, style=line.style_dashed)

line.new(bar_index + highest_index, extension_1272, bar_index, extension_1272,

color=color.green, width=2, style=line.style_dashed)

line.new(bar_index + highest_index, extension_1618, bar_index, extension_1618,

color=color.orange, width=2, style=line.style_dashed)

line.new(bar_index + highest_index, extension_2618, bar_index, extension_2618,

color=color.red, width=2, style=line.style_dashed)

This script automatically detects highs and lows within specified periods and calculates/displays appropriate Fibonacci Extension levels according to current trend direction. Using the Pine Script Editor enables even more advanced customization and adding unique logic.

Adaptive Operation According to Market Environment

Auto Fib Extension effectiveness varies greatly depending on market environment. In strong trending markets, Fibonacci Extension levels mainly function as price targets, with prices tending to sequentially break through these levels. Meanwhile, in range markets or correction phases, these levels often function as powerful support or resistance, becoming price reversal points.

Considering the high volatility characteristic of cryptocurrency markets, price reactions at Fibonacci levels tend to appear more prominently than in traditional financial markets. On Bitcoin daily charts, 161.8% and 261.8% extension levels frequently play important roles at major trend reversal points.

Utilizing TradingView's alert features enables automating notifications when prices approach Fibonacci Extension levels, minimizing risks of missing important trading opportunities. This is particularly important functionality in 24-hour cryptocurrency markets.

Integrated Analysis with Other Technical Indicators

Combining with other technical indicators is effective for improving Auto Fib Extension accuracy. Combining with momentum indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) enables more accurate evaluation of price reversal possibilities at Fibonacci levels.

For example, when prices reach 161.8% extension levels while RSI exceeds 70 showing overbought conditions, the possibility increases that profit-taking at that level or considering new short positions may be effective. Conversely, when RSI falls below 30 in oversold conditions while prices reach Fibonacci support levels, this can be evaluated as a rebound buying opportunity.

TradingView's indicator library publishes numerous custom indicators integrating Fibonacci Extensions with other indicators, enabling construction of analytical environments according to individual trading styles.

Analysis Optimization by Timeframes

Auto Fib Extension effectiveness varies greatly depending on the timeframe used. On short-term timeframes (1-hour or 4-hour charts), Fibonacci levels function more frequently but tend to have lower reliability compared to long-term timeframes. Meanwhile, on long-term timeframes like daily or weekly charts, Fibonacci Extension level reliability increases but signal frequency decreases.

An effective approach is simultaneously analyzing Fibonacci Extensions across multiple timeframes and identifying price zones where they overlap. For example, when weekly 161.8% extension and daily 261.8% extension are positioned in the same price zone, that zone has a high possibility of functioning as a very important level.

Utilizing TradingView's multi-timeframe analysis features enables efficiently conducting such composite analysis. Integrating information from different timeframes makes more reliable investment decisions possible.

Utilization in Risk Management

Auto Fib Extension plays an important role not only in price prediction but also in risk management. Stop-loss settings based on Fibonacci Extension levels enable flexible risk management corresponding to natural market price movements. For example, when entering at 100% extension levels, setting previous highs or lows as stop-losses enables maintaining appropriate risk-reward ratios.

Fibonacci Extensions are also effective in position sizing. Taking larger positions at more reliable levels (such as levels overlapping across multiple timeframes) and smaller positions at uncertain levels enables maximizing risk-adjusted returns.

Psychological Factors and Market Participant Behavioral Patterns

One reason Fibonacci Extensions function is that many market participants are conscious of these levels. Since many institutional investors and individual traders use Fibonacci levels as price targets or stop-loss levels, orders naturally concentrate at these price zones, making price stagnation and reversals more likely to occur.

In cryptocurrency markets, such collective psychology tends to work particularly strongly for major issues like Bitcoin. At important Fibonacci Extension levels, large volumes of profit-taking orders and new entry orders await, and large trading often occurs when prices reach those levels.

Application to Long-Term Investment Strategies

Auto Fib Extension can be effectively utilized not only for short-term trading but also for long-term investment strategies. Analyzing Fibonacci Extensions on monthly or weekly charts enables setting price targets spanning several months to years. This is particularly useful for asset classes like cryptocurrencies where long-term growth is expected.

Through TradingView's long-term chart analysis, analyzing Bitcoin's past major cycles confirms that major highs were formed near 261.8% or 423.6% extension levels from previous cycles. Such long-term perspectives become important guidelines for investment timing optimization and asset allocation decisions.

Practical Operational Considerations

When applying Auto Fib Extension to actual trading, several important considerations exist. First, understanding that Fibonacci Extensions are probabilistic methods that don't guarantee 100% accuracy is necessary. Therefore, combinations with other analytical methods and integration with appropriate risk management are essential.

Additionally, structural market changes or abnormal events (regulatory changes, technical problems, sudden macroeconomic changes, etc.) may cause Fibonacci levels to not function. To respond to such situations, constantly paying attention to market environment changes and adjusting analytical methods as necessary is important.

Backtesting and Continuous Improvement

Objective evaluation of Auto Fib Extension effectiveness requires backtesting using historical data. Quantitatively evaluating performance under different market environments, timeframes, and parameter settings to find optimal operational methods is necessary.

Using TradingView's Strategy Tester enables detailed analysis of Fibonacci Extension-based trading strategies. Through metrics like win rate, average profit, and maximum drawdown, understanding strategy strengths and weaknesses and continuous improvement become possible.

Conclusion

Auto Fib Extension is a powerful price prediction method combining mathematical foundations with market psychology. In cryptocurrency trading, due to high volatility and 24-hour market characteristics, price reactions at Fibonacci Extension levels tend to appear more prominently. Automated analysis enables objective, consistent price target setting and building rational trading strategies that eliminate emotional judgments.

Through multi-timeframe analysis, combinations with other technical indicators, and integration with appropriate risk management, Auto Fib Extension effectiveness can be maximized. Additionally, continuous learning and backtesting to optimize for market environment changes becomes the key to success.

From technical implementation to practical operation, comprehensively understanding and utilizing Auto Fib Extension will significantly improve cryptocurrency trading skills and enable more reliable investment results. By developing multi-faceted analytical capabilities that can respond to market complexity, stable long-term profits become achievable.

For those who wish to learn Pine Script programming more deeply, please utilize TradingView's Pine Script Official Reference.

Disclaimer

The design, implementation, operation of automated trading systems and related financial transactions should all be judged and executed at the user's own discretion and responsibility. The author and the publication medium (Qiita) assume no legal or financial responsibility for any damages or losses arising from these activities.

This article is intended to provide information based on the author's technical verification and operational experience with TradingView and Pine Script. While efforts have been made regarding the accuracy and completeness of the content, its validity and applicability are not guaranteed.

Since market trading inherently involves risks, it is recommended to conduct sufficient backtesting and risk assessment before actual capital investment, and to seek professional advice when necessary.

Please utilize this article after fully understanding and agreeing to the above matters.