『経済・ファイナンスデータの計量時系列分析』

の章末問題で「コンピュータを用いて」とあるものをRで解いています。

6.4

msci<-read.table("msci_day.txt", header=T)

msci.log<-log(msci[,2:8])

dim(msci.log)

[1] 1391 7

(1)

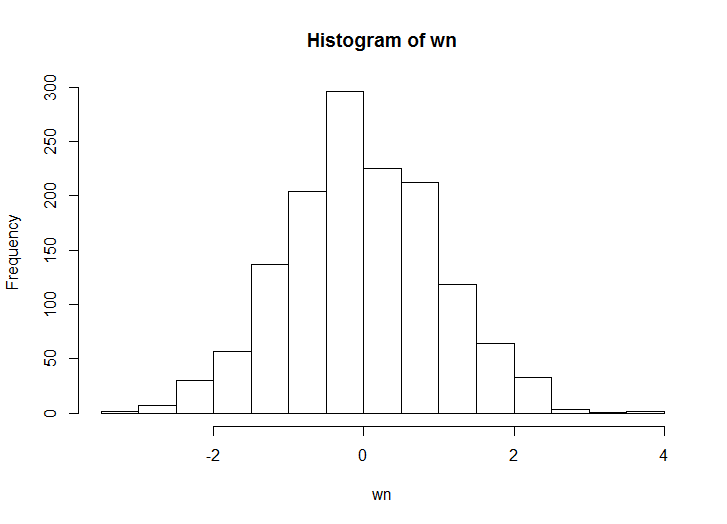

set.seed(1)

wn<-rnorm(1391)

hist(wn)

(2)

out<-data.frame(matrix(1:21,nrow=7,ncol=3))

for (i in 1:7) {

tmp.p<-lm(msci.log[,i]~wn)

tmp.p.beta<-tmp.p$coefficients[2]

tmp.f.stat<-summary(tmp.p)$fstatistic

tmp.p.p.value<-1-pf(tmp.f.stat["value"],tmp.f.stat["numdf"],tmp.f.stat["dendf"])

tmp.p.adj.r.squared<-summary(tmp.p)$adj.r.squared

out[i,]<-data.frame(matrix(c(tmp.p.beta, tmp.p.p.value, tmp.p.adj.r.squared), nrow=1))

}

colnames(out)<-c("推定値β^", "p値", "決定係数")

rownames(out)<-colnames(msci.log)

out

推定値β^ p値 決定係数

ca -0.005197388 0.5748192 -0.0004931680

fr -0.003196312 0.6706261 -0.0005895938

ge -0.003614680 0.6928374 -0.0006074941

it -0.003411967 0.5995188 -0.0005212435

jp -0.001184826 0.8467281 -0.0006930146

uk -0.002621959 0.6630235 -0.0005831074

us -0.002241276 0.5714044 -0.0004890948

調整済み決定係数なので、負の値になっているが実質ほぼ0。

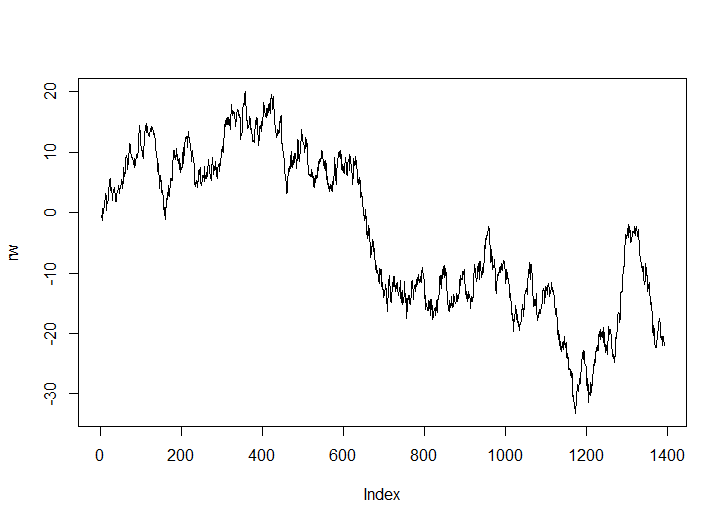

(3)

rw<-cumsum(wn)

plot(rw, type="l")

(4)

out<-data.frame(matrix(1:21,nrow=7,ncol=3))

for (i in 1:7) {

tmp.p<-lm(msci.log[,i]~rw)

tmp.p.beta<-tmp.p$coefficients[2]

tmp.f.stat<-summary(tmp.p)$fstatistic

tmp.p.p.value<-1-pf(tmp.f.stat["value"],tmp.f.stat["numdf"],tmp.f.stat["dendf"])

tmp.p.adj.r.squared<-summary(tmp.p)$adj.r.squared

out[i,]<-data.frame(matrix(c(tmp.p.beta, tmp.p.p.value, tmp.p.adj.r.squared), nrow=1))

}

colnames(out)<-c("推定値β^", "p値", "決定係数")

rownames(out)<-colnames(msci.log)

out

推定値β^ p値 決定係数

ca -0.022671268 0 0.6988062

fr -0.017622486 0 0.6416288

ge -0.021094733 0 0.6201344

it -0.014705891 0 0.5976875

jp -0.013653738 0 0.5790067

uk -0.013868895 0 0.6199455

us -0.008966661 0 0.5982770

見せかけの回帰の現象が見られる。

テキストとホワイトノイズの値が異なるので値は一致しないが、p125の表6.1と同等にp値が0で決定係数が高めに出ている。

(5)

for (i in 1:1) {

rw_1<-0

y_1<-0

rw_1[1]<-0

y_1[1]<-0

for (j in 2:1391) {

rw_1[j]<-rw[j-1]

y_1[j]<-msci.log[j-1,i]

}

tmp.p<-lm(msci.log[,i]~rw+rw_1+y_1)

tmp.p.beta<-tmp.p$coefficients[2]

tmp.f.stat<-summary(tmp.p)$fstatistic

tmp.p.p.value<-1-pf(tmp.f.stat["value"],tmp.f.stat["numdf"],tmp.f.stat["dendf"])

tmp.p.adj.r.squared<-summary(tmp.p)$adj.r.squared

out[i,]<-data.frame(matrix(c(tmp.p.beta, tmp.p.p.value, tmp.p.adj.r.squared), nrow=1))

}

colnames(out)<-c("推定値β^", "p値", "決定係数")

rownames(out)<-colnames(msci.log)

out

推定値β^ p値 決定係数

ca -0.007613280 0 0.8812688

fr -0.017622486 0 0.6416288

ge -0.021094733 0 0.6201344

it -0.014705891 0 0.5976875

jp -0.013653738 0 0.5790067

uk -0.013868895 0 0.6199455

us -0.008966661 0 0.5982770

見せかけの回帰の現象が見られる。

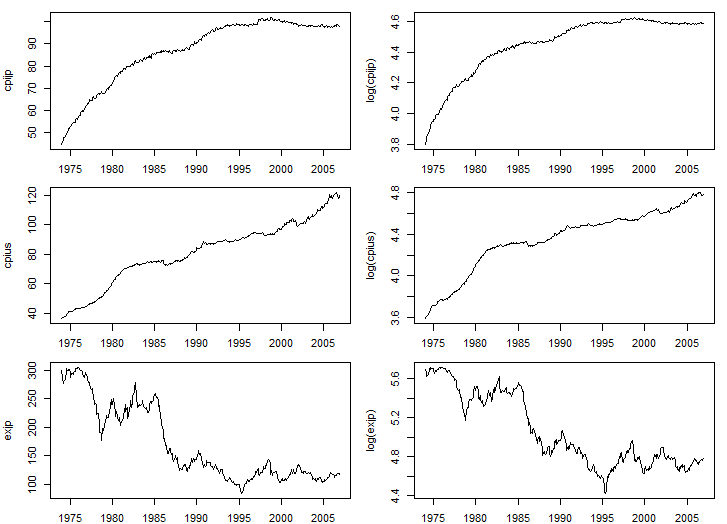

6.5

ppp<-read.table("ppp.txt", header=T)

(1)

lcpijp<-ts(log(ppp$cpijp),start=c(1974,1),frequency=12)

lcpius<-ts(log(ppp$cpius),start=c(1974,1),frequency=12)

lexjp<-ts(log(ppp$exjp),start=c(1974,1),frequency=12)

par(mfrow=c(3,2))

par(mar=c(2,4,1,1))

ts.plot(ts(ppp$cpijp,start=c(1974,1),frequency=12),ylab="cpijp")

ts.plot(lcpijp,ylab="log(cpijp)")

ts.plot(ts(ppp$cpius,start=c(1974,1),frequency=12),ylab="cpius")

ts.plot(lcpius,ylab="log(cpius)")

ts.plot(ts(ppp$exjp,start=c(1974,1),frequency=12),ylab="exjp")

ts.plot(lexjp,ylab="log(exjp)")

(2)

library(tseries)

adf.test(lcpijp)

adf.test(lcpijp, alternative = "explosive")

adf.test(lcpius)

adf.test(lcpius, alternative = "explosive")

adf.test(lexjp)

adf.test(lexjp, alternative = "explosive")

> adf.test(lcpijp)

Augmented Dickey-Fuller Test

data: lcpijp

Dickey-Fuller = -4.0654, Lag order = 7, p-value = 0.01

alternative hypothesis: stationary

Warning message:

In adf.test(lcpijp) : p-value smaller than printed p-value

> adf.test(lcpijp, alternative = "explosive")

Augmented Dickey-Fuller Test

data: lcpijp

Dickey-Fuller = -4.0654, Lag order = 7, p-value = 0.99

alternative hypothesis: explosive

Warning message:

In adf.test(lcpijp, alternative = "explosive") :

p-value smaller than printed p-value

> adf.test(lcpius)

Augmented Dickey-Fuller Test

data: lcpius

Dickey-Fuller = -2.4815, Lag order = 7, p-value =

0.3739

alternative hypothesis: stationary

> adf.test(lcpius, alternative = "explosive")

Augmented Dickey-Fuller Test

data: lcpius

Dickey-Fuller = -2.4815, Lag order = 7, p-value =

0.6261

alternative hypothesis: explosive

> adf.test(lexjp)

Augmented Dickey-Fuller Test

data: lexjp

Dickey-Fuller = -1.6156, Lag order = 7, p-value =

0.7396

alternative hypothesis: stationary

> adf.test(lexjp, alternative = "explosive")

Augmented Dickey-Fuller Test

data: lexjp

Dickey-Fuller = -1.6156, Lag order = 7, p-value =

0.2604

alternative hypothesis: explosive

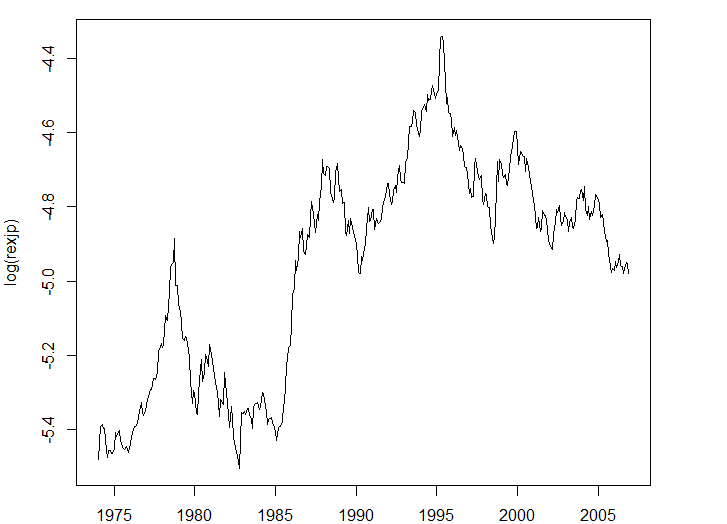

(3)

lrexjp<-lcpijp-lcpius-lexjp

par(mar=c(2,4,1,4))

plot(lrexjp, ylab="log(rexjp)")

(4)

PPP仮説は

$$

lcpijp \approx lexjp + lcpius

$$

であるから

$$

lcpijp - lcpius - lexjp = lrexjp \approx 0

$$

よりlrexjpが0に収束することを示唆している。

(5)

adf.test(lrexjp)

adf.test(lrexjp, alternative = "explosive")

adf.test(diff(lrexjp))

> adf.test(lrexjp)

Augmented Dickey-Fuller Test

data: lrexjp

Dickey-Fuller = -1.3335, Lag order = 7, p-value =

0.8587

alternative hypothesis: stationary

> adf.test(lrexjp, alternative = "explosive")

Augmented Dickey-Fuller Test

data: lrexjp

Dickey-Fuller = -1.3335, Lag order = 7, p-value =

0.1413

alternative hypothesis: explosive

> adf.test(diff(lrexjp))

Augmented Dickey-Fuller Test

data: diff(lrexjp)

Dickey-Fuller = -6.7109, Lag order = 7, p-value = 0.01

alternative hypothesis: stationary

Warning message:

In adf.test(diff(lrexjp)) : p-value smaller than printed p-value

より、単位根がある。このためlrexjpの値が収束しないので、PPP仮説を支持していない。

(6)

library(urca)

lrexjp.df<-data.frame(lcpijp, -lcpius, -lexjp)

lrexjp.vecm<-ca.jo(lrexjp.df, ecdet="none", type="eigen", K=6, spec="longrun", season=NULL)

summary(lrexjp.vecm)

> summary(lrexjp.vecm)

######################

# Johansen-Procedure #

######################

Test type: maximal eigenvalue statistic (lambda max) , with linear trend

Eigenvalues (lambda):

[1] 0.158408638 0.032735262 0.002925689

Values of teststatistic and critical values of test:

test 10pct 5pct 1pct

r <= 2 | 1.14 6.50 8.18 11.65

r <= 1 | 12.98 12.91 14.90 19.19

r = 0 | 67.26 18.90 21.07 25.75

Eigenvectors, normalised to first column:

(These are the cointegration relations)

lcpijp.l6 X.lcpius.l6 X.lexjp.l6

lcpijp.l6 1.00000000 1.0000000 1.0000000

X.lcpius.l6 0.02892562 0.2519313 0.7927706

X.lexjp.l6 -0.07537271 -0.3823289 0.1300192

Weights W:

(This is the loading matrix)

lcpijp.l6 X.lcpius.l6 X.lexjp.l6

lcpijp.d -0.021872635 0.002756738 -0.0007592322

X.lcpius.d 0.014398742 0.008619883 -0.0038549536

X.lexjp.d 0.002801142 0.061199460 0.0184638162

r = 1

r+1=2個の共和分関係が存在する。よってPPP仮説を支持する。

(7)

lcpica<-ts(log(ppp$cpica),start=c(1974,1),frequency=12)

lcpiuk<-ts(log(ppp$cpiuk),start=c(1974,1),frequency=12)

lexca<-ts(log(ppp$exca),start=c(1974,1),frequency=12)

lexuk<-ts(log(ppp$exuk),start=c(1974,1),frequency=12)

lrexca.df<-data.frame(lcpica, -lcpius, -lexca)

lrexca.vecm<-ca.jo(lrexca.df, ecdet="none", type="eigen", K=6, spec="longrun", season=NULL)

summary(lrexca.vecm)

######################

# Johansen-Procedure #

######################

Test type: maximal eigenvalue statistic (lambda max) , with linear trend

Eigenvalues (lambda):

[1] 0.104204155 0.016269511 0.002260424

Values of teststatistic and critical values of test:

test 10pct 5pct 1pct

r <= 2 | 0.88 6.50 8.18 11.65

r <= 1 | 6.40 12.91 14.90 19.19

r = 0 | 42.92 18.90 21.07 25.75

Eigenvectors, normalised to first column:

(These are the cointegration relations)

lcpica.l6 X.lcpius.l6 X.lexca.l6

lcpica.l6 1.00000000 1.0000000 1.000000

X.lcpius.l6 0.97756101 1.2966193 2.087184

X.lexca.l6 0.04893602 0.6192151 -1.629409

Weights W:

(This is the loading matrix)

lcpica.l6 X.lcpius.l6 X.lexca.l6

lcpica.d -0.013164472 -0.001479385 0.0003232371

X.lcpius.d 0.009339536 -0.007286482 -0.0011414028

X.lexca.d 0.032099791 -0.011930871 0.0031450132

lrexuk.df<-data.frame(lcpiuk, -lcpius, -lexuk)

lrexuk.vecm<-ca.jo(lrexuk.df, ecdet="none", type="eigen", K=6, spec="longrun", season=NULL)

summary(lrexuk.vecm)

######################

# Johansen-Procedure #

######################

Test type: maximal eigenvalue statistic (lambda max) , with linear trend

Eigenvalues (lambda):

[1] 0.128672334 0.030943227 0.007768275

Values of teststatistic and critical values of test:

test 10pct 5pct 1pct

r <= 2 | 3.04 6.50 8.18 11.65

r <= 1 | 12.26 12.91 14.90 19.19

r = 0 | 53.72 18.90 21.07 25.75

Eigenvectors, normalised to first column:

(These are the cointegration relations)

lcpiuk.l6 X.lcpius.l6 X.lexuk.l6

lcpiuk.l6 1.0000000 1.0000000 1.000000

X.lcpius.l6 0.5757486 1.3613908 1.945102

X.lexuk.l6 -2.0586854 0.9541808 -0.105148

Weights W:

(This is the loading matrix)

lcpiuk.l6 X.lcpius.l6 X.lexuk.l6

lcpiuk.d -0.005272950 -0.003607554 0.001152957

X.lcpius.d 0.002705188 -0.006229943 -0.003849241

X.lexuk.d 0.011352610 -0.017602665 0.026309049

r = 1

r+1=2個の共和分関係が存在する。よってPPP仮説を支持する。