簡単な使い方

- ブラウザで⇒アクセス Gooogle colabo のページ

- (パラメータ変更して)実行ボタンを押す

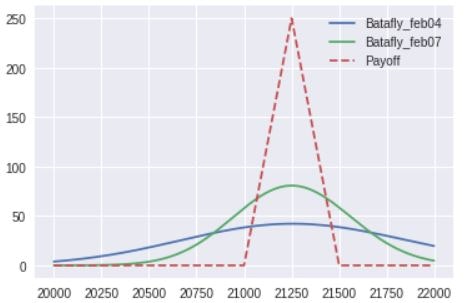

パラメータ変更例1:

# 3月限ショートストラングル

p = Portfolio(

"""

03/C21000[-1]

03/P20000[-1]

""")

# マーケット情報設定書式

# setting(原資産価格, IV(%), 日付【yyyymmdd】)

setting(20250, 25, 20190204)

内部の概略

Quantlibからよく使われるブラックショールズ式を簡単に呼び出せるラッパークラスを作成。

インストールする場合

pip install simple_option

主なクラス

Portfolio

Option

Payoff

クラス利用例:

Example1

---------

from simpleOption import *

# Simple Example

o = Option('02/P20500')

op_price = o.v(20625, 20.8, 20190124)

print(f"{o}@{op_price:.2f} (nk=20625,IV=20.8%) jan24 ")

OUTPUT 1

---------

02/P20500@285.49 (nk=20625,IV=20.8%) jan24

Example2

---------

# underlying change: 20625 >>20500

op_price2 = o.v(20500)

print(f"{o}@{op_price2:.2f} (nk=20500,IV=20.8%) jan24")

OUTPUT 2

---------

02/P20500@285.49 (nk=20625,IV=20.8%) jan24

Example3

---------

# underlying & IV change: 20625>>20000 &IV=25%

op_price3 = o.v(20000, 25)

print(f"{o}@{op_price3:.2f} (nk=20000,IV=25%) jan24")

OUTPUT 3

---------

02/P20500@703.62 (nk=20000,IV=25%) jan24

Example4

---------

# use keyword

op = Option('02/P20500')

op_price4 = op(

underlying=20250,

iv=25,

evaluationDate=20190122

)

"""