今回は,Quantopian Research を使って,株式市場の雰囲気をつかむ指標を書いてみたいと思います.

HighLowRatio とは

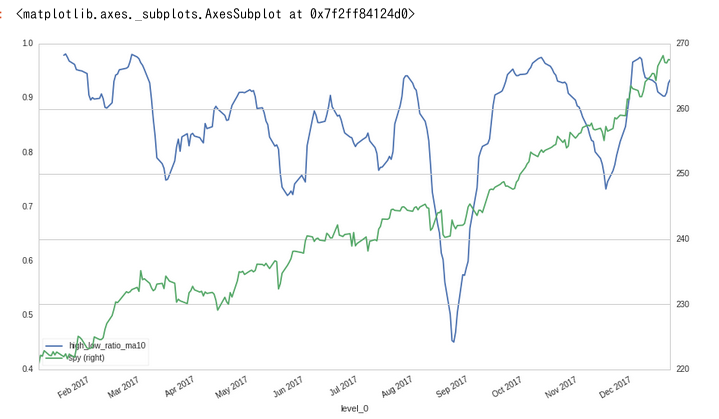

今日の価格が,過去一年で高値だった銘柄数と安値だった銘柄数の比率です.

HighLowRatioの,

- 数値が100%に近ければ、市場がイケイケドンドン\(^o^)/

- 数値が0%に近ければ、(((( ;゚д゚))))アワワワワ

という雰囲気を示します.

計算式は,

Highの銘柄数 / (Highの銘柄数 + Lowの銘柄数)

という簡単なモノです.

これだとブレが大きいので10日移動平均を取ることが多いです.

Quantopian Research を使う

では,Quantopian Research を使って,計算してみましょう.

from quantopian.pipeline.experimental import QTradableStocksUS

from quantopian.pipeline.data.builtin import USEquityPricing

from quantopian.pipeline.factors import CustomFactor

from quantopian.research import run_pipeline

from quantopian.pipeline import Pipeline

import numpy as np

class isHighToday(CustomFactor):

inputs = [USEquityPricing.high]

window_length = 252

def compute(self, today, asset_ids, out, values):

max_values = np.nanmax(values,axis=0)

high_252 = max_values == values[-1]

out[:] = high_252

class isLowToday(CustomFactor):

inputs = [USEquityPricing.low]

window_length = 252

def compute(self, today, asset_ids, out, values):

min_values = np.nanmin(values,axis=0)

low_252 = min_values == values[-1]

out[:] = low_252

def make_pipeline1():

base_universe = QTradableStocksUS()

pipe = Pipeline()

pipe.add(isHighToday(), "isHighToday")

pipe.add(isLowToday(), "isLowToday")

pipe.set_screen(base_universe)

return pipe

start_date = '2017-01-01'

end_date = '2017-12-22'

results = run_pipeline(make_pipeline1(),

start_date=start_date,

end_date = end_date )

# highlows = results.reset_index().groupby(by = "level_0")[["isHighToday", "isLowToday"]].sum()

highlows = results.groupby(level=0)[["isHighToday", "isLowToday"]].sum()

highlows["high_low_ratio"] = highlows["isHighToday"] / ( highlows["isHighToday"] + highlows["isLowToday"])

highlows["high_low_ratio_ma10"] = highlows["high_low_ratio"].rolling(10).mean()

spy = get_pricing("SPY", start_date=start_date,end_date= end_date, fields='price')

highlows["spy"] = spy

highlows[["high_low_ratio_ma10", "spy"]].plot(secondary_y = "spy")

解説

-

銘柄の選定は

base_universe = QTradableStocksUS()で行っています.これは Quantopian が用意している,トレーダブルな銘柄集です.詳しくはQTradableStocksUS()をご参照下さい. -

9月頃にHighLowRatioが大きく落ちていますが,これは8月17日のトランプ氏、2助言組織を解散 企業首脳が相次ぎ辞任を受けてマーケットが過剰反応し,SPが1.5%以上落ちた影響を受けています.

-

multiindex を reset_index せずに groupby する方法がわからず,reset しています.どなたかご存知でしたらご教授下さいm(__)mコメントで @driller さんに教えて頂きました!ありがとうございます! -

次回イベントでは,やはりリサーチの勉強した方が良いかもしれないな...

今後の Tokyo Quantopian User Group

相変わらずなにも決めてないのですが,1月にしたい!という希望だけはあります!

メリークリスマス!