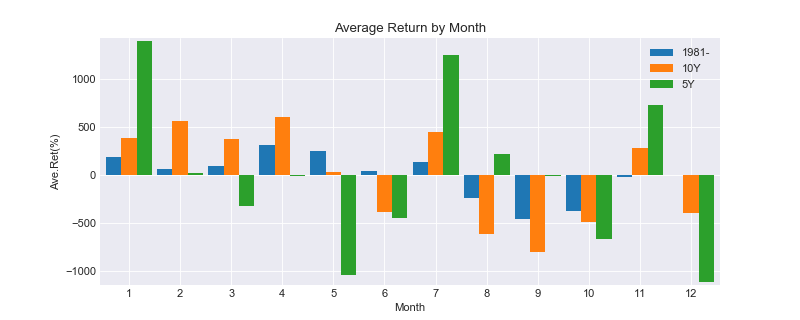

月次リターンのカレンダー効果を検証

statsmodelsのdecomposeを用いて、ハロウィーン効果、Sell in Mayなど巷で言われるカレンダー効果が見られるか実験

import numpy as np

import pandas as pd

import statsmodels.api as sm

import pandas_datareader.data as web

import warnings

warnings.filterwarnings('ignore')

import matplotlib.pyplot as plt

plt.style.use('seaborn-darkgrid')

plt.rcParams['axes.xmargin'] = 0.01

plt.rcParams['axes.ymargin'] = 0.01

window = 250*3

'''S&P500データ取得 '''

data1 = web.DataReader("^GSPC", "yahoo", "1980/1/1").dropna()

# Treasury Yield 10 Yearsデータ取得

data2 = web.DataReader("^TNX", "yahoo", "1980/1/1").dropna()

# 日々年率Volatility = 10%にレバレッジ調整した設定

ret = pd.DataFrame(data1['Adj Close'] / data1['Adj Close'].shift(1) - 1)

ret = 0.1 * ret / (ret.rolling(252).std()*np.sqrt(252)).shift(1)

data1 = 100*((1 + ret).cumprod()).dropna(axis=0)

data1_freq = data1.resample('M').last().fillna(method='ffill')

data1_freq['ret1'] = data1_freq['Adj Close']/data1_freq['Adj Close'].shift(1) - 1

# 月次ターンを再作成

data1_freq_equity_curve = 100*((1 + data1_freq['ret1']).cumprod()).dropna(axis=0)

data1_freq_equity_curve.index = pd.to_datetime(data1_freq_equity_curve.index)

# 通期、10年(120ヵ月)、5年(60ヵ月)

res_all = sm.tsa.seasonal_decompose(data1_freq_equity_curve, freq=12)

res_10Y = sm.tsa.seasonal_decompose(data1_freq_equity_curve[-120:], freq=12)

res_5Y = sm.tsa.seasonal_decompose(data1_freq_equity_curve[-60:], freq=12)

seasonality = pd.concat([res_all.seasonal,

res_10Y.seasonal,

res_5Y.seasonal], axis=1)

seasonality.columns = ['1981-', '10Y', '5Y']

m_seasonality = seasonality.groupby(seasonality.index.month).mean()

# Creat Figure

month = m_seasonality.index

height = m_seasonality * 100

bar_width = 0.3

plt.figure(figsize=(10, 4), dpi=80)

plt.bar(month, height['1981-'], tick_label=month,

width=0.3, label='1981-')

plt.bar(month + bar_width, height['10Y'], tick_label=month,

width=0.3, label='10Y')

plt.bar(month + 2*bar_width, height['5Y'], tick_label=month,

width=0.3, label='5Y')

plt.xticks(month + bar_width, month)

plt.legend()

plt.title("Average Return by Month")

plt.xlabel("Month")

plt.ylabel("Ave.Ret(%)")

plt.show()

seasonalにリターンを見ると

- Sell in Mayは近年言えてそう

- 年末売り/年初買い?

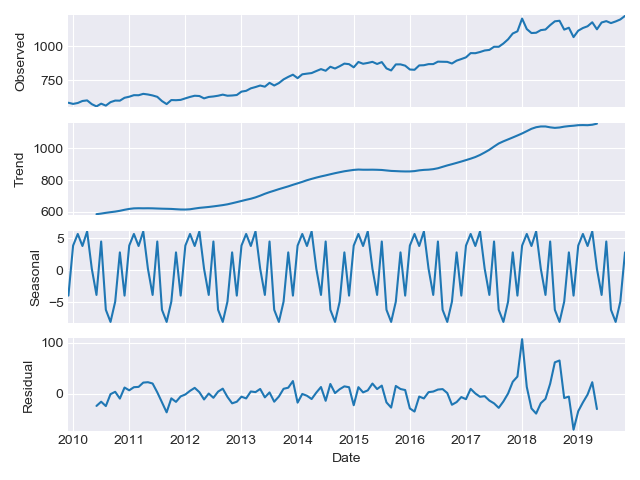

Decomposition(Trend, Seasonality, Residual)

res_10Y.plot()

plt.show()

- 短期的な平均回帰や、マーケット動向を把握するのに使用

- 過去のマーケット環境(Volatility水準の差etc.)の調整が工夫入りそう