やりたいこと

- yfinanceの使い方

- ローソクチャートの作成

- 移動平均の計算とグラフへの記載

参考URL

- yfinanceを使って株価データや財務情報を取得する方法 - データテックログ

- yfinance · PyPI

- Pythonで株の情報を取得したい - リラックスした生活を過ごすために

- 【Python】Yahoo!financeのデータでローソク足を作成してみよう - ジェイの投資ライフ

yfinanceを利用した株価取得

yfinanceのインストール

Python環境コマンドラインにて以下を実行。

pip install yfinance

yfinanceを使った株価情報の取得(1976:明星工)

import yfinance as yf

# 明星工の情報を取得

ticker_info = yf.Ticker("1976.T")

# 株価データ(日毎)を取得(DataFrame形式)

hist = ticker_info.history(period="max")

# 取得データの表示

hist

結果

Open High Low Close Volume Dividends Stock Splits

Date

2000-04-04 00:00:00+09:00 96.852356 96.852356 95.586312 96.852356 22000 0.0 0.0

2000-04-05 00:00:00+09:00 96.852356 96.852356 96.852356 96.852356 3000 0.0 0.0

2000-04-06 00:00:00+09:00 98.118408 98.118408 98.118408 98.118408 6000 0.0 0.0

2000-04-07 00:00:00+09:00 98.118408 98.751430 98.118408 98.118408 3000 0.0 0.0

2000-04-10 00:00:00+09:00 98.751427 98.751427 98.751427 98.751427 18000 0.0 0.0

... ... ... ... ... ... ... ...

2023-09-21 00:00:00+09:00 1015.000000 1038.000000 1015.000000 1030.000000 57100 0.0 0.0

2023-09-22 00:00:00+09:00 1017.000000 1031.000000 1012.000000 1024.000000 86400 0.0 0.0

2023-09-25 00:00:00+09:00 1035.000000 1035.000000 1020.000000 1026.000000 66300 0.0 0.0

2023-09-26 00:00:00+09:00 1022.000000 1030.000000 1015.000000 1025.000000 66100 0.0 0.0

2023-09-27 00:00:00+09:00 1022.000000 1046.000000 1015.000000 1045.000000 96500 0.0 0.0

5874 rows × 7 columns

取得時の条件指定方法

import yfinance as yf

# 明星工の情報を取得

stock_code = "1976.T"

# 期間を指定して情報を取得する

start = '2023-08-01'

end = '2023-09-26'

hist1 = yf.download(tickers=stock_code, start=start, end=end)

print("********2023/8/1から9/26の株情報(日毎)********")

print(hist1)

# 直近1日の分足情報を取得する

# 取得期間の設定:period→1d,5d,1mo,3mo,6mo,1y,2y,5y,10y,ytd,max

# 取得間隔の指定:interval→1m,2m,5m,15m,30m,60m,90m,1h,1d,5d,1wk,1mo,3mo

hist2 = yf.download(tickers=stock_code, period='1d', interval='1m')

print("********直近一日の株情報(分毎)********")

print(hist2)

結果

[*********************100%%**********************] 1 of 1 completed

********2023/8/1から9/26の株情報(日毎)********

Open High Low Close Adj Close Volume

Date

2023-08-01 949.0 956.0 936.0 949.0 949.0 184300

2023-08-02 939.0 951.0 931.0 937.0 937.0 160300

2023-08-03 933.0 933.0 912.0 917.0 917.0 194800

2023-08-04 913.0 920.0 910.0 916.0 916.0 119500

2023-08-07 916.0 922.0 914.0 918.0 918.0 49500

2023-08-08 923.0 927.0 906.0 907.0 907.0 63000

2023-08-09 909.0 910.0 898.0 906.0 906.0 68100

2023-08-10 907.0 928.0 903.0 928.0 928.0 94800

2023-08-14 929.0 935.0 923.0 927.0 927.0 66900

2023-08-15 928.0 933.0 925.0 933.0 933.0 69000

2023-08-16 931.0 938.0 929.0 935.0 935.0 50000

2023-08-17 936.0 939.0 923.0 936.0 936.0 196400

2023-08-18 931.0 936.0 907.0 912.0 912.0 84200

2023-08-21 920.0 922.0 915.0 917.0 917.0 52700

2023-08-22 917.0 924.0 911.0 922.0 922.0 116400

2023-08-23 922.0 926.0 917.0 924.0 924.0 34500

2023-08-24 922.0 932.0 922.0 930.0 930.0 50600

2023-08-25 924.0 930.0 921.0 925.0 925.0 86200

2023-08-28 934.0 953.0 933.0 950.0 950.0 125500

2023-08-29 951.0 954.0 941.0 943.0 943.0 88800

2023-08-30 947.0 954.0 944.0 951.0 951.0 118700

2023-08-31 955.0 965.0 953.0 959.0 959.0 131100

2023-09-01 964.0 978.0 963.0 974.0 974.0 77500

2023-09-04 975.0 994.0 975.0 993.0 993.0 99500

2023-09-05 993.0 996.0 988.0 996.0 996.0 93100

2023-09-06 996.0 1008.0 995.0 1006.0 1006.0 96600

2023-09-07 999.0 1014.0 999.0 1007.0 1007.0 109800

2023-09-08 1001.0 1003.0 980.0 981.0 981.0 176200

2023-09-11 985.0 985.0 973.0 975.0 975.0 88200

2023-09-12 983.0 992.0 974.0 990.0 990.0 69500

2023-09-13 987.0 993.0 983.0 991.0 991.0 129400

2023-09-14 986.0 1009.0 984.0 1006.0 1006.0 88600

2023-09-15 1020.0 1067.0 1019.0 1061.0 1061.0 198800

2023-09-19 1060.0 1062.0 1043.0 1062.0 1062.0 100700

2023-09-20 1062.0 1062.0 1027.0 1031.0 1031.0 98500

2023-09-21 1015.0 1038.0 1015.0 1030.0 1030.0 57100

2023-09-22 1017.0 1031.0 1012.0 1024.0 1024.0 86400

2023-09-25 1035.0 1035.0 1020.0 1026.0 1026.0 66300

[*********************100%%**********************] 1 of 1 completed

********直近一日の株情報(分毎)********

Open High Low Close Adj Close Volume

Datetime

2023-09-27 09:00:00+09:00 1022.0 1022.0 1020.0 1020.0 1020.0 0

2023-09-27 09:03:00+09:00 1016.0 1016.0 1015.0 1015.0 1015.0 1000

2023-09-27 09:04:00+09:00 1017.0 1017.0 1017.0 1017.0 1017.0 100

2023-09-27 09:05:00+09:00 1015.0 1015.0 1015.0 1015.0 1015.0 200

2023-09-27 09:06:00+09:00 1016.0 1016.0 1016.0 1016.0 1016.0 100

... ... ... ... ... ... ...

2023-09-27 14:54:00+09:00 1042.0 1042.0 1042.0 1042.0 1042.0 400

2023-09-27 14:55:00+09:00 1043.0 1043.0 1043.0 1043.0 1043.0 600

2023-09-27 14:57:00+09:00 1044.0 1044.0 1043.0 1043.0 1043.0 500

2023-09-27 14:58:00+09:00 1043.0 1043.0 1042.0 1042.0 1042.0 900

2023-09-27 14:59:00+09:00 1044.0 1046.0 1043.0 1043.0 1043.0 4900

[137 rows x 6 columns]

yfinanceを使った企業情報の取得(1976:明星工)

# 明星工の情報を取得

stock_code = "1976.T"

# 指定した証券コードの企業情報を取得(JSON形式)

ticker_info = yf.Ticker(stock_code)

# 取得した情報の出力

# バランスシート

print("********バランスシート********")

print(ticker_info.balancesheet)

# キャッシュフロー

print("********キャッシュフロー********")

print(ticker_info.cashflow)

# 財務

print("********財務********")

print(ticker_info.financials)

# 配当

print("********配当********")

print(ticker_info.dividends)

結果

********バランスシート********

2023-03-31 \

Treasury Shares Number 6587371.0

Ordinary Shares Number 49799347.0

Share Issued 56386718.0

Total Debt 800000000.0

Tangible Book Value 58991000000.0

... ...

Other Receivables 6009000000.0

Accounts Receivable 16275000000.0

Cash Cash Equivalents And Short Term Investments 29317000000.0

Other Short Term Investments 300000000.0

Cash And Cash Equivalents 29017000000.0

2022-03-31 \

Treasury Shares Number 6614632.0

Ordinary Shares Number 49772086.0

Share Issued 56386718.0

Total Debt 960000000.0

Tangible Book Value 55487000000.0

... ...

Other Receivables 4011000000.0

Accounts Receivable 15354000000.0

Cash Cash Equivalents And Short Term Investments 27492000000.0

Other Short Term Investments 300000000.0

Cash And Cash Equivalents 27192000000.0

2021-03-31 2020-03-31

Treasury Shares Number 8114323.0 8121256.0

Ordinary Shares Number 51272395.0 51265462.0

Share Issued 59386718.0 59386718.0

Total Debt 1020000000.0 960000000.0

Tangible Book Value 53911000000.0 50371000000.0

... ... ...

Other Receivables 2173000000.0 1351000000.0

Accounts Receivable 18288000000.0 18864000000.0

Cash Cash Equivalents And Short Term Investments 22884000000.0 19691000000.0

Other Short Term Investments 400000000.0 300000000.0

Cash And Cash Equivalents 22484000000.0 19391000000.0

[64 rows x 4 columns]

********キャッシュフロー********

2023-03-31 2022-03-31 \

Free Cash Flow 3133000000.0 6920000000.0

Repurchase Of Capital Stock 0.0 -1128000000.0

Repayment Of Debt -960000000.0 -60000000.0

Issuance Of Debt 800000000.0 0.0

Issuance Of Capital Stock 5000000.0 74000000.0

Capital Expenditure -935000000.0 -251000000.0

End Cash Position 29004000000.0 27183000000.0

Other Cash Adjustment Outside Changein Cash NaN NaN

Beginning Cash Position 27183000000.0 22471000000.0

Effect Of Exchange Rate Changes 319000000.0 211000000.0

Changes In Cash 1502000000.0 4501000000.0

Financing Cash Flow -1739000000.0 -2661000000.0

Net Other Financing Charges 16000000.0 NaN

Cash Dividends Paid -1600000000.0 -1542000000.0

Common Stock Dividend Paid NaN NaN

Net Common Stock Issuance 5000000.0 -1054000000.0

Common Stock Payments 0.0 -1128000000.0

Common Stock Issuance 5000000.0 74000000.0

Net Issuance Payments Of Debt -160000000.0 -60000000.0

Net Long Term Debt Issuance -160000000.0 -60000000.0

Long Term Debt Payments -960000000.0 -60000000.0

Long Term Debt Issuance 800000000.0 0.0

Investing Cash Flow -827000000.0 -9000000.0

Net Other Investing Changes 19000000.0 287000000.0

Dividends Received Cfi 77000000.0 62000000.0

Net Investment Purchase And Sale 12000000.0 -107000000.0

Sale Of Investment 461000000.0 507000000.0

Purchase Of Investment -449000000.0 -614000000.0

Net PPE Purchase And Sale -935000000.0 -251000000.0

Purchase Of PPE -935000000.0 -251000000.0

Operating Cash Flow 4068000000.0 7171000000.0

Taxes Refund Paid -1764000000.0 -2178000000.0

Interest Received Cfo 144000000.0 116000000.0

Interest Paid Cfo -4000000.0 -4000000.0

Change In Working Capital -2041000000.0 3259000000.0

Change In Other Current Liabilities NaN NaN

Change In Other Current Assets -61000000.0 640000000.0

Change In Payable 2076000000.0 513000000.0

Change In Inventory -70000000.0 430000000.0

Change In Receivables -3869000000.0 1706000000.0

Other Non Cash Items 87000000.0 -267000000.0

Depreciation And Amortization 568000000.0 761000000.0

Depreciation 568000000.0 761000000.0

Gain Loss On Investment Securities -148000000.0 -115000000.0

Net Foreign Currency Exchange Gain Loss -30000000.0 -45000000.0

Net Income From Continuing Operations 6901000000.0 5641000000.0

2021-03-31 2020-03-31

Free Cash Flow 4377000000.0 404000000.0

Repurchase Of Capital Stock 0.0 -800000000.0

Repayment Of Debt -740000000.0 -310000000.0

Issuance Of Debt 800000000.0 250000000.0

Issuance Of Capital Stock 6000000.0 35000000.0

Capital Expenditure -788000000.0 -511000000.0

End Cash Position 22471000000.0 19381000000.0

Other Cash Adjustment Outside Changein Cash -2000000.0 2000000.0

Beginning Cash Position 19381000000.0 20642000000.0

Effect Of Exchange Rate Changes -72000000.0 -2000000.0

Changes In Cash 3164000000.0 -1261000000.0

Financing Cash Flow -1469000000.0 -2376000000.0

Net Other Financing Charges 14000000.0 12000000.0

Cash Dividends Paid -1541000000.0 -1563000000.0

Common Stock Dividend Paid NaN -1563000000.0

Net Common Stock Issuance 6000000.0 -765000000.0

Common Stock Payments 0.0 -800000000.0

Common Stock Issuance 6000000.0 35000000.0

Net Issuance Payments Of Debt 60000000.0 -60000000.0

Net Long Term Debt Issuance 60000000.0 -60000000.0

Long Term Debt Payments -740000000.0 -310000000.0

Long Term Debt Issuance 800000000.0 250000000.0

Investing Cash Flow -532000000.0 200000000.0

Net Other Investing Changes 281000000.0 292000000.0

Dividends Received Cfi 183000000.0 223000000.0

Net Investment Purchase And Sale -208000000.0 196000000.0

Sale Of Investment 407000000.0 863000000.0

Purchase Of Investment -615000000.0 -667000000.0

Net PPE Purchase And Sale -788000000.0 -511000000.0

Purchase Of PPE -788000000.0 -511000000.0

Operating Cash Flow 5165000000.0 915000000.0

Taxes Refund Paid -1978000000.0 -2469000000.0

Interest Received Cfo 121000000.0 150000000.0

Interest Paid Cfo -4000000.0 -5000000.0

Change In Working Capital -490000000.0 -2762000000.0

Change In Other Current Liabilities -76000000.0 -70000000.0

Change In Other Current Assets 428000000.0 -1229000000.0

Change In Payable -1792000000.0 119000000.0

Change In Inventory 62000000.0 -373000000.0

Change In Receivables 788000000.0 -1155000000.0

Other Non Cash Items 85000000.0 -1345000000.0

Depreciation And Amortization 810000000.0 481000000.0

Depreciation 810000000.0 481000000.0

Gain Loss On Investment Securities -121000000.0 -143000000.0

Net Foreign Currency Exchange Gain Loss -1000000.0 13000000.0

Net Income From Continuing Operations 6742000000.0 6996000000.0

********財務********

2023-03-31 \

Tax Effect Of Unusual Items -100328937.835096

Tax Rate For Calcs 0.319519

Normalized EBITDA 7787000000.0

Total Unusual Items -314000000.0

Total Unusual Items Excluding Goodwill -314000000.0

Net Income From Continuing Operation Net Minori... 4680000000.0

Reconciled Depreciation 568000000.0

Reconciled Cost Of Revenue 44309000000.0

EBITDA 7473000000.0

EBIT 6905000000.0

Net Interest Income 30000000.0

Interest Expense 4000000.0

Interest Income 34000000.0

Normalized Income 4893671062.164904

Net Income From Continuing And Discontinued Ope... 4680000000.0

Total Expenses 49059000000.0

Total Operating Income As Reported 6830000000.0

Diluted Average Shares 49789000.0

Basic Average Shares 49789000.0

Diluted EPS 94.0

Basic EPS 94.0

Diluted NI Availto Com Stockholders 4680000000.0

Net Income Common Stockholders 4680000000.0

Otherunder Preferred Stock Dividend 0.0

Net Income 4680000000.0

Minority Interests -16000000.0

Net Income Including Noncontrolling Interests 4696000000.0

Net Income Continuous Operations 4696000000.0

Tax Provision 2205000000.0

Pretax Income 6901000000.0

Other Non Operating Income Expenses 173000000.0

Special Income Charges -352000000.0

Other Special Charges NaN

Write Off 352000000.0

Net Non Operating Interest Income Expense 30000000.0

Interest Expense Non Operating 4000000.0

Interest Income Non Operating 34000000.0

Operating Income 6831000000.0

Operating Expense 4750000000.0

Gross Profit 11581000000.0

Cost Of Revenue 44309000000.0

Total Revenue 55890000000.0

Operating Revenue 55890000000.0

2022-03-31 \

Tax Effect Of Unusual Items 8502000.0

Tax Rate For Calcs 0.327

Normalized EBITDA 6380000000.0

Total Unusual Items 26000000.0

Total Unusual Items Excluding Goodwill 26000000.0

Net Income From Continuing Operation Net Minori... 3793000000.0

Reconciled Depreciation 761000000.0

Reconciled Cost Of Revenue 38464000000.0

EBITDA 6406000000.0

EBIT 5645000000.0

Net Interest Income 11000000.0

Interest Expense 4000000.0

Interest Income 15000000.0

Normalized Income 3775502000.0

Net Income From Continuing And Discontinued Ope... 3793000000.0

Total Expenses 43049000000.0

Total Operating Income As Reported 5339000000.0

Diluted Average Shares 50838000.0

Basic Average Shares 50838000.0

Diluted EPS 74.63

Basic EPS 74.63

Diluted NI Availto Com Stockholders 3793000000.0

Net Income Common Stockholders 3793000000.0

Otherunder Preferred Stock Dividend 0.0

Net Income 3793000000.0

Minority Interests -1000000.0

Net Income Including Noncontrolling Interests 3795000000.0

Net Income Continuous Operations 3795000000.0

Tax Provision 1846000000.0

Pretax Income 5641000000.0

Other Non Operating Income Expenses 131000000.0

Special Income Charges -36000000.0

Other Special Charges 40000000.0

Write Off -4000000.0

Net Non Operating Interest Income Expense 11000000.0

Interest Expense Non Operating 4000000.0

Interest Income Non Operating 15000000.0

Operating Income 5340000000.0

Operating Expense 4585000000.0

Gross Profit 9925000000.0

Cost Of Revenue 38464000000.0

Total Revenue 48389000000.0

Operating Revenue 48389000000.0

2021-03-31 \

Tax Effect Of Unusual Items 32149213.883121

Tax Rate For Calcs 0.315188

Normalized EBITDA 7454000000.0

Total Unusual Items 102000000.0

Total Unusual Items Excluding Goodwill 102000000.0

Net Income From Continuing Operation Net Minori... 4600000000.0

Reconciled Depreciation 810000000.0

Reconciled Cost Of Revenue 39633000000.0

EBITDA 7556000000.0

EBIT 6746000000.0

Net Interest Income 20000000.0

Interest Expense 4000000.0

Interest Income 24000000.0

Normalized Income 4530149213.883121

Net Income From Continuing And Discontinued Ope... 4600000000.0

Total Expenses 44133000000.0

Total Operating Income As Reported 6399000000.0

Diluted Average Shares 51270000.0

Basic Average Shares 51270000.0

Diluted EPS 89.74

Basic EPS 89.74

Diluted NI Availto Com Stockholders 4600000000.0

Net Income Common Stockholders 4600000000.0

Otherunder Preferred Stock Dividend 0.0

Net Income 4600000000.0

Minority Interests -16000000.0

Net Income Including Noncontrolling Interests 4617000000.0

Net Income Continuous Operations 4617000000.0

Tax Provision 2125000000.0

Pretax Income 6742000000.0

Other Non Operating Income Expenses 187000000.0

Special Income Charges 27000000.0

Other Special Charges NaN

Write Off -27000000.0

Net Non Operating Interest Income Expense 20000000.0

Interest Expense Non Operating 4000000.0

Interest Income Non Operating 24000000.0

Operating Income 6400000000.0

Operating Expense 4500000000.0

Gross Profit 10900000000.0

Cost Of Revenue 39633000000.0

Total Revenue 50533000000.0

Operating Revenue 50533000000.0

2020-03-31

Tax Effect Of Unusual Items 62016000.0

Tax Rate For Calcs 0.323

Normalized EBITDA 7290000000.0

Total Unusual Items 192000000.0

Total Unusual Items Excluding Goodwill 192000000.0

Net Income From Continuing Operation Net Minori... 4709000000.0

Reconciled Depreciation 481000000.0

Reconciled Cost Of Revenue 42016000000.0

EBITDA 7482000000.0

EBIT 7001000000.0

Net Interest Income 46000000.0

Interest Expense 5000000.0

Interest Income 51000000.0

Normalized Income 4579016000.0

Net Income From Continuing And Discontinued Ope... 4709000000.0

Total Expenses 46630000000.0

Total Operating Income As Reported 6442000000.0

Diluted Average Shares 51754000.0

Basic Average Shares 51754000.0

Diluted EPS 91.0

Basic EPS 91.0

Diluted NI Availto Com Stockholders 4709000000.0

Net Income Common Stockholders 4709000000.0

Otherunder Preferred Stock Dividend 0.0

Net Income 4709000000.0

Minority Interests -28000000.0

Net Income Including Noncontrolling Interests 4738000000.0

Net Income Continuous Operations 4739000000.0

Tax Provision 2257000000.0

Pretax Income 6996000000.0

Other Non Operating Income Expenses 216000000.0

Special Income Charges 31000000.0

Other Special Charges 20000000.0

Write Off -51000000.0

Net Non Operating Interest Income Expense 46000000.0

Interest Expense Non Operating 5000000.0

Interest Income Non Operating 51000000.0

Operating Income 6443000000.0

Operating Expense 4614000000.0

Gross Profit 11057000000.0

Cost Of Revenue 42016000000.0

Total Revenue 53073000000.0

Operating Revenue 53073000000.0

********配当********

Date

2002-03-26 00:00:00+09:00 2.5

2004-03-26 00:00:00+09:00 2.5

2007-03-27 00:00:00+09:00 3.0

2007-09-25 00:00:00+09:00 3.0

2008-03-26 00:00:00+09:00 3.0

2008-09-25 00:00:00+09:00 3.0

2009-03-26 00:00:00+09:00 3.0

2009-09-25 00:00:00+09:00 3.0

2010-03-29 00:00:00+09:00 3.0

2010-09-28 00:00:00+09:00 3.0

2011-03-29 00:00:00+09:00 3.0

2011-09-28 00:00:00+09:00 3.0

2012-03-28 00:00:00+09:00 3.0

2012-09-26 00:00:00+09:00 3.0

2013-03-27 00:00:00+09:00 3.0

2013-09-26 00:00:00+09:00 3.0

2014-03-27 00:00:00+09:00 2.0

2014-09-26 00:00:00+09:00 4.0

2015-03-27 00:00:00+09:00 4.0

2015-09-28 00:00:00+09:00 5.0

2016-03-29 00:00:00+09:00 5.0

2016-09-28 00:00:00+09:00 6.0

2017-03-29 00:00:00+09:00 8.0

2017-09-27 00:00:00+09:00 8.0

2018-03-28 00:00:00+09:00 18.0

2018-09-26 00:00:00+09:00 10.0

2019-03-27 00:00:00+09:00 20.0

2019-09-27 00:00:00+09:00 10.0

2020-03-30 00:00:00+09:00 20.0

2020-09-29 00:00:00+09:00 10.0

2021-03-30 00:00:00+09:00 12.0

2021-09-29 00:00:00+09:00 10.0

2022-03-30 00:00:00+09:00 20.0

2022-09-29 00:00:00+09:00 12.0

2023-03-30 00:00:00+09:00 24.0

Name: Dividends, dtype: float64

- DataFrame形式で株取引情報が取得できる

- 株価は分足、日足、週足、月足が指定可能

- JSON形式で会社情報の取得ができる

mplfinanceを利用したグラフ表示

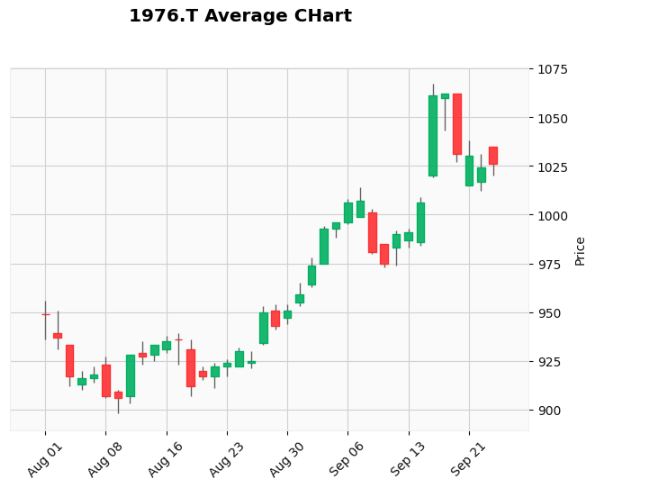

#### ローソク足チャートの表示

import matplotlib.pyplot as plt

import yfinance

import mplfinance as mf

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2023-08-01'

end = '2023-09-26'

hist = yf.download(tickers=stock_code, start=start, end=end, interval='1d', auto_adjust=True)

# auto_adjust:『始値 / 高値 / 安値 / 終値』の四本値を自動的に調整する

#グラフの表示

chart = mf.plot(hist,style='yahoo',type='candle',title='1976.T Average CHart')

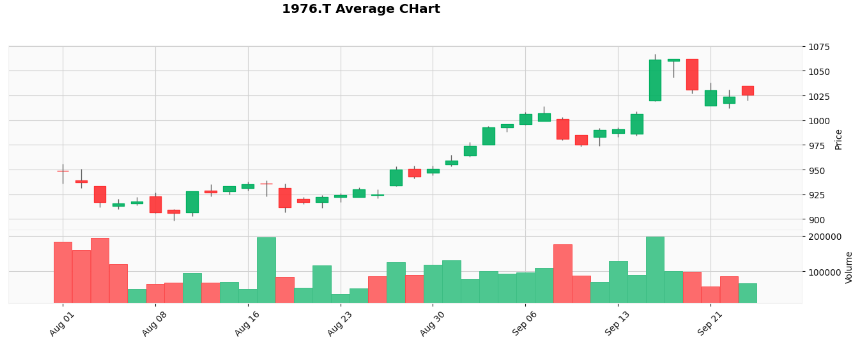

チャートの表示サイズを変更、出来高(ボリューム)表示

import matplotlib.pyplot as plt

import yfinance

import mplfinance as mf

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2023-08-01'

end = '2023-09-26'

hist = yf.download(tickers=stock_code, start=start, end=end, interval='1d', auto_adjust=True)

#グラフの表示

chart = mf.plot(hist,style='yahoo',type='candle',title='1976.T Average CHart',

figratio=(12,4), #縦横のサイズ指定

volume=True) #出来高(ボリューム)を表示

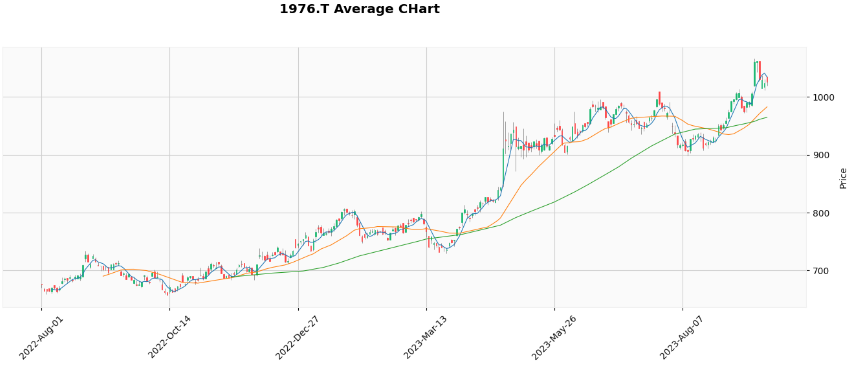

取得したデータで移動平均を計算する

mplfinanceを使ってグラフに移動平均線を追加する

import matplotlib.pyplot as plt

import yfinance

import mplfinance as mf

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2022-08-01'

end = '2023-09-26'

hist = yf.download(tickers=stock_code, start=start, end=end, interval='1d', auto_adjust=True)

#グラフの表示

chart = mf.plot(hist,style='yahoo',type='candle',title='1976.T Average CHart', figratio=(12,4),

mav=(5,25,75))

移動平均を計算する(DataFrame型)

import yfinance

from datetime import datetime, timedelta, timezone

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2022-08-01'

end = '2023-09-26'

stock = yf.download(tickers=stock_code, start=start, end=end, interval='1d')

# 列を追加し、平均を計算する

stock['5ma'] = stock['Adj Close'].rolling(window=5).mean()

stock['25ma'] = stock['Adj Close'].rolling(window=25).mean()

stock['75ma'] = stock['Adj Close'].rolling(window=75).mean()

# 結果を表示

stock

結果

Open High Low Close Adj Close Volume 5ma 25ma 75ma

Date

2022-08-01 710.0 710.0 703.0 708.0 674.555725 70600 NaN NaN NaN

2022-08-02 700.0 702.0 696.0 696.0 663.122620 100300 NaN NaN NaN

2022-08-03 700.0 700.0 691.0 696.0 663.122620 56000 NaN NaN NaN

2022-08-04 701.0 701.0 695.0 696.0 663.122620 42800 NaN NaN NaN

2022-08-05 695.0 704.0 692.0 702.0 668.839172 59900 666.552551 NaN NaN

... ... ... ... ... ... ... ... ... ...

2023-09-19 1060.0 1062.0 1043.0 1062.0 1062.000000 100700 1022.000000 967.16 959.693333

2023-09-20 1062.0 1062.0 1027.0 1031.0 1031.000000 98500 1030.200000 971.08 961.240000

2023-09-21 1015.0 1038.0 1015.0 1030.0 1030.000000 57100 1038.000000 974.88 962.613333

2023-09-22 1017.0 1031.0 1012.0 1024.0 1024.000000 86400 1041.600000 978.40 963.613333

2023-09-25 1035.0 1035.0 1020.0 1026.0 1026.000000 66300 1034.600000 982.96 964.813333

284 rows × 9 columns

移動平均の値が途切れないようにする

import pandas as pd

import yfinance

import mplfinance as mf

from datetime import datetime, timedelta, timezone

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2021-08-01' #移動平均の計算をするために描画する期間よりも前からデータを取得しておく

end = '2023-09-26'

stock = yf.download(tickers=stock_code, start=start, end=end, interval='1d')

# 列を追加し、平均を計算する

stock['5ma'] = stock['Adj Close'].rolling(window=5).mean()

stock['25ma'] = stock['Adj Close'].rolling(window=25).mean()

stock['75ma'] = stock['Adj Close'].rolling(window=75).mean()

# 実際に使いたい期間だけにする

stock=stock[stock.index > datetime(2022,8,1)]

stock

結果

Open High Low Close Adj Close Volume 5ma 25ma 75ma

Date

2022-08-02 700.0 702.0 696.0 696.0 663.122620 100300 675.508508 671.964233 669.410833

2022-08-03 700.0 700.0 691.0 696.0 663.122620 56000 671.316357 671.735571 669.690310

2022-08-04 701.0 701.0 695.0 696.0 663.122620 42800 668.076978 671.468796 669.817345

2022-08-05 695.0 704.0 692.0 702.0 668.839172 59900 666.552551 671.392576 670.109526

2022-08-08 707.0 707.0 700.0 702.0 668.839172 31700 665.409241 671.659351 670.439817

... ... ... ... ... ... ... ... ... ...

2023-09-19 1060.0 1062.0 1043.0 1062.0 1062.000000 100700 1022.000000 967.160000 959.693333

2023-09-20 1062.0 1062.0 1027.0 1031.0 1031.000000 98500 1030.200000 971.080000 961.240000

2023-09-21 1015.0 1038.0 1015.0 1030.0 1030.000000 57100 1038.000000 974.880000 962.613333

2023-09-22 1017.0 1031.0 1012.0 1024.0 1024.000000 86400 1041.600000 978.400000 963.613333

2023-09-25 1035.0 1035.0 1020.0 1026.0 1026.000000 66300 1034.600000 982.960000 964.813333

283 rows × 9 columns

グラフで表示

import pandas as pd

import yfinance

import mplfinance as mf

from datetime import datetime, timedelta, timezone

#データの取得(明星工:1976.T)

stock_code = "1976.T"

start = '2021-08-01' #移動平均の計算をするために描画する期間よりも前からデータを取得しておく

end = '2023-09-26'

stock = yf.download(tickers=stock_code, start=start, end=end, interval='1d')

stock['5ma'] = stock['Adj Close'].rolling(window=5).mean()

stock['25ma'] = stock['Adj Close'].rolling(window=25).mean()

stock['75ma'] = stock['Adj Close'].rolling(window=75).mean()

stock=stock[stock.index > datetime(2022,8,1)]

# グラフ表示

addplot_ma = mf.make_addplot(stock[['5ma','25ma','75ma']],width=2)

mf.plot(stock, style='yahoo', type='candle', addplot = addplot_ma, figratio=(12,4), )

~とりあえず今日はここまで~

- DataFrameの行を条件で抽出(移動平均の5と25が同値になったタイミングを抽出)

- (参照)pandas.DataFrameの行を条件で抽出するquery _ note.nkmk.me