■ 概要

TA-Libを用いた判断指標(SMA, EMA, BB, RSI, MACD, ATR)の算出して

mplfinanceを用いて表示させる

一連のコードは↓

■ 環境

device : Mac book air 2022

yfinance : 0.2.12 (Released: Feb 16, 2023)

mplfinance : 0.12.9b7

pandas : 1.3.5

■ 実装

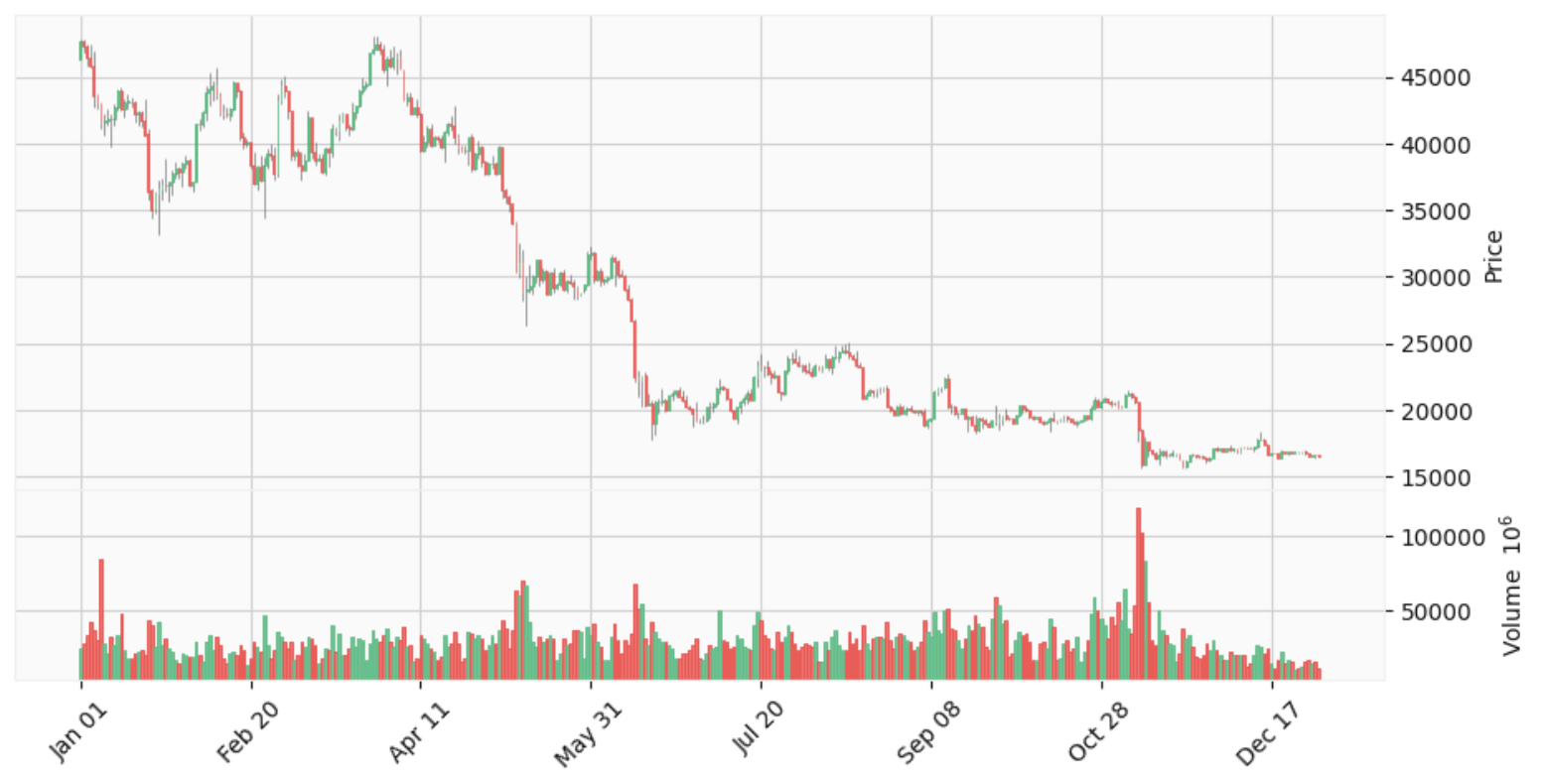

( 1 ) データ収集 & ローソク足の表示

●データ収集

yfinanceでビットコインのデータを収集しました。

データの詳細としては、2022年の日足のデータを収集しました。

!pip install yfinance

#yfinanceとpandasをインポート

import yfinance as yf

import pandas as pd

#取得するデータ詳細

name = 'BTC-USD'

start = '2022-01-01'

end = '2022-12-31'

#データのダウンロード

df = yf.download(tickers=name, start=start, end=end)

df.head(3)

| Date | Open | High | Low | Close | Adj Close | Volume |

|---|---|---|---|---|---|---|

| 2022-01-01 | 46311.746094 | 47827.312500 | 46288.484375 | 47686.812500 | 47686.812500 | 24582667004 |

| 2022-01-02 | 47680.925781 | 47881.406250 | 46856.937500 | 47345.218750 | 47345.218750 | 27951569547 |

| 2022-01-03 | 47343.542969 | 47510.726562 | 45835.964844 | 46458.117188 | 46458.117188 | 33071628362 |

yfinanceの詳細はこの記事をご覧ください。

●ローソク足の表示

!pip install mplfinance

import mplfinance as mpf

mpf.plot(df, type="candle", figratio = (4, 2), volume=True, style="yahoo")

mplfinanceの詳細はこの記事をご覧ください。

( 2 ) Ta-Libをインストールする

!pip install TA-Lib

( 3 ) SMA(移動平均線)

●SMAを算出する

import talib

import numpy as np

df['SMA20'] = talib.SMA(np.array(df['Close']), 20)

df['SMA50'] = talib.SMA(np.array(df['Close']), 50)

df['SMA100'] = talib.SMA(np.array(df['Close']), 100)

df[['SMA20', 'SMA50', 'SMA100']].tail(3)

| Date | SMA20 | SMA50 | SMA100 |

|---|---|---|---|

| 2022-12-29 | 16945.709570 | 16821.523574 | 18212.409941 |

| 2022-12-30 | 16919.402637 | 16801.839863 | 18192.961797 |

| 2022-12-31 | 16891.567773 | 16792.103926 | 18164.301250 |

●SMAをmplfinanceを使って表示させる

sma = [ mpf.make_addplot(df['SMA20'], color="red"),

mpf.make_addplot(df['SMA50'], color="blue"),

mpf.make_addplot(df['SMA100'], color="green")]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=sma)

( 4 ) EMA(指数平滑移動平均線)

●EMAを算出する

df['EMA20'] = talib.EMA(np.array(df['Close']), 20)

df['EMA50'] = talib.EMA(np.array(df['Close']), 50)

df['EMA100'] = talib.EMA(np.array(df['Close']), 100)

df[['EMA20', 'EMA50', 'EMA100']].tail(3)

| Date | EMA20 | EMA50 | EMA100 |

|---|---|---|---|

| 2022-12-29 | 16857.778948 | 17269.299841 | 18345.835924 |

| 2022-12-30 | 16833.474851 | 17243.154197 | 18311.316123 |

| 2022-12-31 | 16806.238779 | 17215.873488 | 18276.388993 |

●EMAをmplfinanceを使って表示させる

ema = [ mpf.make_addplot(df['EMA20'], color="red"),

mpf.make_addplot(df['EMA50'], color="blue"),

mpf.make_addplot(df['EMA100'], color="green")]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=ema)

( 5 ) BB(ボリンジャーバンド)

●BBを算出する

bb_period = 10

sigma = 2

matype = 0

df['BB_up'], df['BB_middle'], df['BB_down'] = talib.BBANDS(np.array(df['Close']), bb_period, sigma, sigma, matype)

df[['BB_up', 'BB_middle', 'BB_down']].tail(3)

| Date | BB_up | BB_middle | bb_down |

|---|---|---|---|

| 2022-12-29 | 17008.412859 | 16787.276953 | 16566.141048 |

| 2022-12-30 | 16987.531515 | 16756.905078 | 16526.278641 |

| 2022-12-31 | 16987.470883 | 16729.901172 | 16472.331461 |

●BBをmplfinanceを使って表示させる

bb = [ mpf.make_addplot(df['BB_up'], color="blue"),

mpf.make_addplot(df['BB_middle'], color="red"),

mpf.make_addplot(df['BB_down'], color="blue")]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=bb)

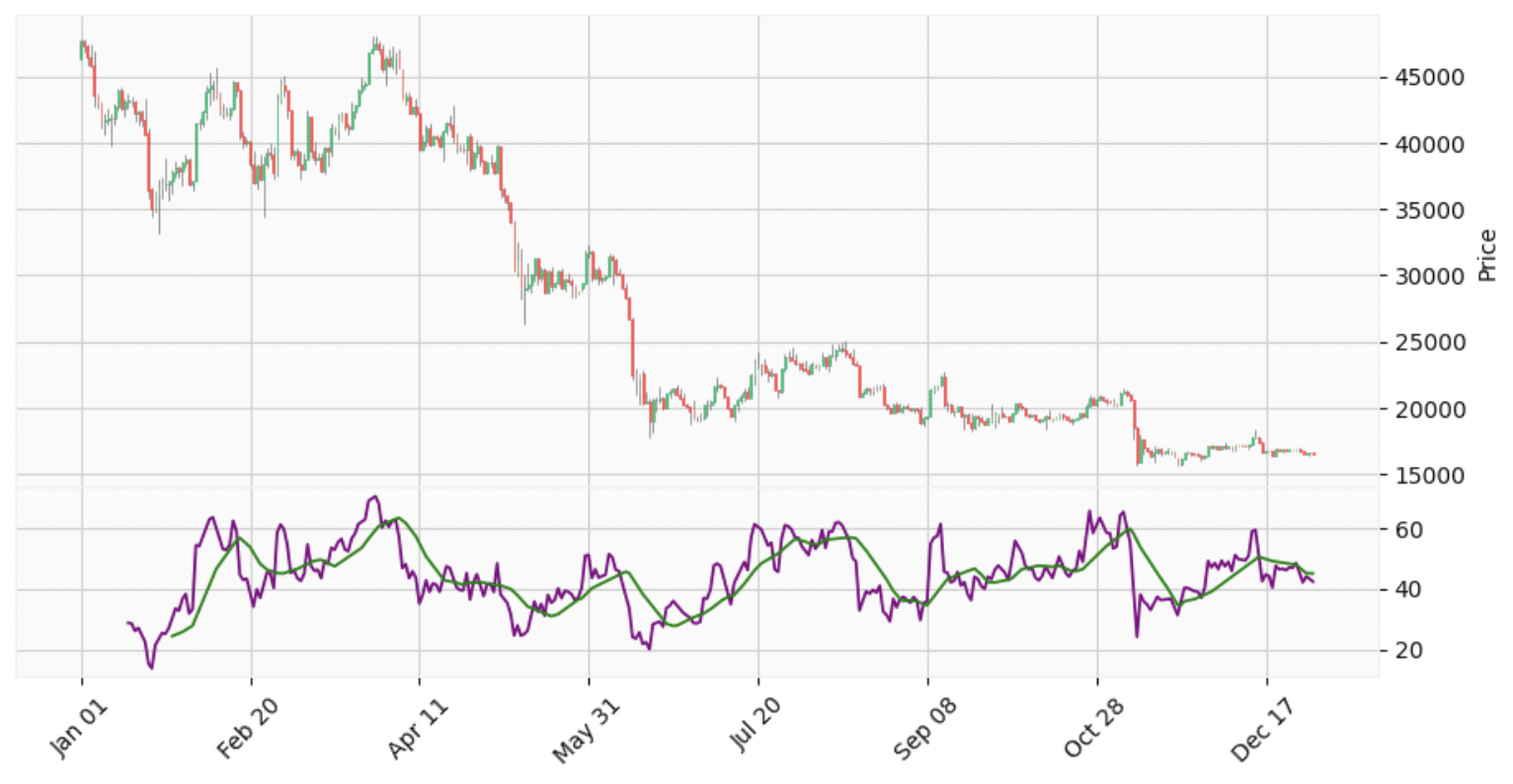

( 6 ) RSI(相対力指数)

●RSIを算出する

rsi_period = 14

df['RSI'] = talib.RSI(df['Close'])

df['RSI_SMA14'] = talib.SMA(np.array(df['RSI']), rsi_period)

df[['RSI', 'RSI_SMA14']].tail(3)

| Date | RSI | RSI_SMA14 |

|---|---|---|

| 2022-12-29 | 44.125248 | 45.155021 |

| 2022-12-30 | 43.408369 | 45.219953 |

| 2022-12-31 | 42.380864 | 45.054581 |

●RSIをmplfinanceを使って表示させる

rsi = [ mpf.make_addplot(df['RSI'], color="purple",panel=1),

mpf.make_addplot(df['RSI_SMA14'], color="green",panel=1)]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=rsi)

( 7 ) MACD(移動平均収束拡散手法)

●MACDを算出する

fast_period = 12

slow_period = 26

signal_period = 9

df["MACD"], df["MACD_signal"], df["MACD_hist"] = talib.MACD(df['Close'], fast_period, slow_period, signal_period)

df[['MACD', 'MACD_signal', 'MACD_hist']].tail(3)

| Date | MACD | MACD_signal | MACD_hist |

|---|---|---|---|

| 2022-12-29 | -125.238723 | -110.046230 | -15.192493 |

| 2022-12-30 | -130.839866 | -114.204957 | -16.634909 |

| 2022-12-31 | -138.131805 | -118.990327 | -19.141478 |

●MACDをmplfinanceを使って表示させる

macd = [

mpf.make_addplot(df["MACD"], color='blue', panel=1),

mpf.make_addplot(df["MACD_signal"], color='red', panel=1),

mpf.make_addplot(df["MACD_hist"],type='bar', panel=1)

]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=macd)

( 8 ) ATR

●ATRを算出する

atr_period = 3

df["ATR"] = talib.ATR(np.array(df['High']), np.array(df['Low']), np.array(df['Close']), timeperiod=atr_period)

df[['ATR']].tail(3)

| Date | ATR |

|---|---|

| 2022-12-29 | 197.939283 |

| 2022-12-30 | 210.277230 |

| 2022-12-31 | 177.340419 |

●ATRをmplfinanceを使って表示させる

atr = [mpf.make_addplot(df["ATR"], color='blue', panel=1)]

mpf.plot(df, type="candle", figratio = (4, 2), style="yahoo", addplot=atr)

■ 参考文献