続報である

状況

- 1d足トレードではなく、より短期足(15m,30m,60m)との組み合わせで、3チャンネルを組み合わせた。

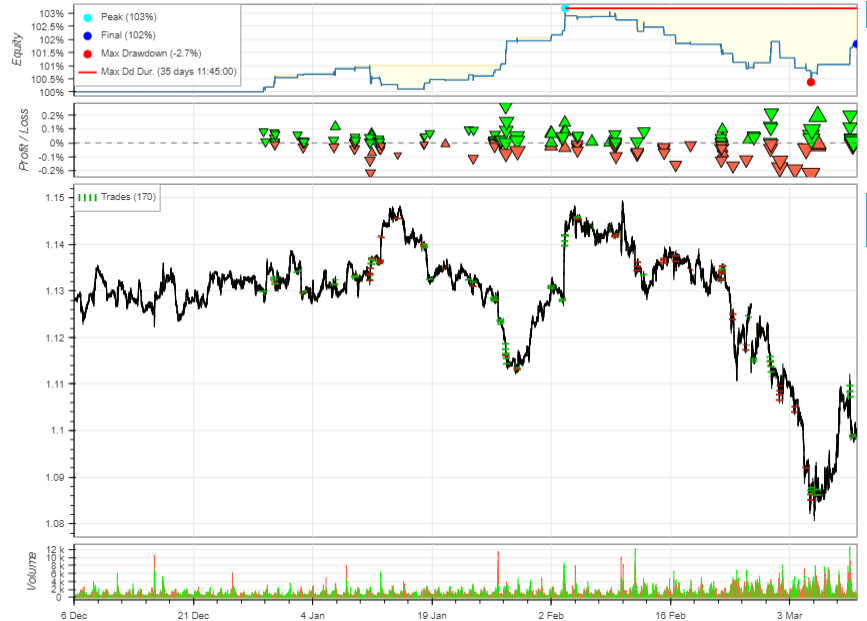

- バックテスト結果から、勝率60%を得た。

- Trades 170

- Win Rate [%] 60.0

苦労した部分

- PIX2PIXでの学習データにおいて、過去値と予測値の時系列スライド(重複部分)は、データ中の3/4とした。

- データサイズは 過去16+48 未来48+16 重複48 → 64x4倍して256サイズに変換

- バックテストでは、バイナリオプションを想定したアルゴリズムを実装した。

- バックテストシグナルは、すべて予測チャート上での変化率で検出した。

実装

Trainデータの作成

main.py

import pandas as pd

import datetime as dt

from pandas_datareader import data

import mplfinance as mpf

import torch

from torchvision.datasets import ImageFolder

from torchvision import models, transforms

import torch.nn as nn

import numpy as np

import os

os.environ['KMP_DUPLICATE_LIB_OK']='True'

df1 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k15.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df1.index = pd.to_datetime(df1['date']+" "+df1['time'])

df2 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k30.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df2.index = pd.to_datetime(df2['date']+" "+df2['time'])

df3 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k60.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df3.index = pd.to_datetime(df3['date']+" "+df3['time'])

wsize=80 #サンプル期間

alldata1 =[]

alldata2=[]

alldata3=[]

for time in range(len(df1)-wsize):

try:

dfspan = df1[time:time+wsize]

alldata1.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

for time in range(len(df2)-wsize):

try:

dfspan = df2[time:time+wsize]

alldata2.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

for time in range(len(df3)-wsize):

try:

dfspan = df3[time:time+wsize]

alldata3.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

# In[2]:

from PIL import Image

import matplotlib.pyplot as plt

from tqdm import tqdm

import pdb

def min_max(x, axis=None):

min = x.min(axis=axis, keepdims=True)

max = x.max(axis=axis, keepdims=True)

result = (x-min)/(max-min)

return result

def imagemake(dfspan1,dfspan2,dfspan3):

a = min_max(np.array([x for x in dfspan1['df']['close']]))

d = min_max(np.array([x for x in dfspan2['df']['close']]))

g = min_max(np.array([x for x in dfspan3['df']['close']]))

m = np.outer(a,a).astype(np.float32)

n = np.outer(d,d).astype(np.float32)

o = np.outer(g,g).astype(np.float32)

m1 = min_max(m[0:64,0:64])

m2 = min_max(m[16:80,16:80])

n1 = min_max(n[0:64,0:64])

n2 = min_max(n[16:80,16:80])

o1 = min_max(o[0:64,0:64])

o2 = min_max(o[16:80,16:80])

te1 = np.stack([m1,n1,o1])

te2 = np.stack([m2,n2,o2])

te3=np.concatenate([te1,te2], 2)

#te1 = np.stack([m1,n1,o1])

#te2 = np.stack([m2,n2,o2])

#te3=np.concatenate([te2,te2], 2)#real = fake = te2で与える

te4=np.kron(te3, np.ones((4,4)))

tmp = torch.from_numpy(te4).clone()

return transforms.ToPILImage(mode='RGB')(tmp)

# In[3]:

alldata3s = alldata3[:-1]

alldata2s = alldata2[:-1]

i1pick=False

i2pick=False

for i1,i1s in tqdm(zip(reversed(alldata3),reversed(alldata3s))):

if i1['date'].index >= alldata2[-1]['date'].index:

continue

for i2,i2s in zip(reversed(alldata2),reversed(alldata2s)):

if i1['date'].index >= i2['date'].index and i2['date'].index>i1s['date'].index:

i1pick=i1s

else:

i1pick=False

continue

if i2['date'].index >= alldata1[-1]['date'].index:

continue

for i3 in reversed(alldata1):

if i2['date'].index > i3['date'].index and i3['date'].index>=i2s['date'].index:

i2pick=i2s

else:

i2pick=False

continue

if (i1pick and i2pick):

img=imagemake(i3,i2pick,i1pick)

fn = i3['df'].tail(1).index.astype(str).values.tolist()

fn1 = i2pick['df'].tail(1).index.astype(str).values.tolist()

fn2 = i1pick['df'].tail(1).index.astype(str).values.tolist()

print(fn,fn1,fn2)

fname = "datasets/facades1/train/" + fn[0].replace(":","-") + ".png"

if len(fn[0])<16:

fname = fname.replace(".png"," 00-00-00.png")

img.save(fname)

train

python train.py --dataroot ./datasets/facades1 --name facades_pix2pix1 --model pix2pix --direction AtoB --batch_size 32 --gpu_ids 0,1 --no_flip

未来予測

future.py

import pandas as pd

import datetime as dt

from pandas_datareader import data

import mplfinance as mpf

import torch

from torchvision.datasets import ImageFolder

from torchvision import models, transforms

import torch.nn as nn

import numpy as np

import os

os.environ['KMP_DUPLICATE_LIB_OK']='True'

df1 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k15.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df1.index = pd.to_datetime(df1['date']+" "+df1['time'])

df2 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k30.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df2.index = pd.to_datetime(df2['date']+" "+df2['time'])

df3 = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k60.csv', sep=",",names=('date', 'time', 'open', 'high', 'low', 'close', 'volume'))

df3.index = pd.to_datetime(df3['date']+" "+df3['time'])

wsize=96 #サンプル期間

alldata1 =[]

alldata2=[]

alldata3=[]

for time in range(len(df1)-wsize):

try:

dfspan = df1[time:time+wsize]

alldata1.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

for time in range(len(df2)-wsize):

try:

dfspan = df2[time:time+wsize]

alldata2.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

for time in range(len(df3)-wsize):

try:

dfspan = df3[time:time+wsize]

alldata3.append({"df":dfspan,"date":dfspan.tail(1)})

except:

pass

# In[33]:

from PIL import Image

import matplotlib.pyplot as plt

from tqdm import tqdm

import pdb

def min_max(x, axis=None):

min = x.min(axis=axis, keepdims=True)

max = x.max(axis=axis, keepdims=True)

result = (x-min)/(max-min)

return result

def imagemake(dfspan1,dfspan2,dfspan3):

a = min_max(np.array([x for x in dfspan1['df']['close']]))

d = min_max(np.array([x for x in dfspan2['df']['close']]))

g = min_max(np.array([x for x in dfspan3['df']['close']]))

m = np.outer(a,a).astype(np.float32)

n = np.outer(d,d).astype(np.float32)

o = np.outer(g,g).astype(np.float32)

m1 = min_max(m[0:64,0:64])

m2 = min_max(m[16:80,16:80])

n1 = min_max(n[0:64,0:64])

n2 = min_max(n[16:80,16:80])

o1 = min_max(o[0:64,0:64])

o2 = min_max(o[16:80,16:80])

te1 = np.stack([m1,n1,o1])

te2 = np.stack([m2,n2,o2])

te3=np.concatenate([te2,te2], 2)#real = fake = te2で与える

te4=np.kron(te3, np.ones((4,4)))

tmp = torch.from_numpy(te4).clone()

return transforms.ToPILImage(mode='RGB')(tmp)

# In[34]:

COUNT=5000

alldata3s = alldata3[:-1]

alldata2s = alldata2[:-1]

i1pick=False

i2pick=False

countloop =0

for i1,i1s in tqdm(zip(reversed(alldata3),reversed(alldata3s))):

if i1['date'].index >= alldata2[-1]['date'].index:

continue

for i2,i2s in zip(reversed(alldata2),reversed(alldata2s)):

if i1['date'].index >= i2['date'].index and i2['date'].index>i1s['date'].index:

i1pick=i1s

else:

i1pick=False

continue

if i2['date'].index >= alldata1[-1]['date'].index:

continue

for i3 in reversed(alldata1):

if i2['date'].index > i3['date'].index and i3['date'].index>=i2s['date'].index:

i2pick=i2s

else:

i2pick=False

continue

if (i1pick and i2pick):

img=imagemake(i3,i2pick,i1pick)

fn = i3['df'].tail(1).index.astype(str).values.tolist()

fn1 = i2pick['df'].tail(1).index.astype(str).values.tolist()

fn2 = i1pick['df'].tail(1).index.astype(str).values.tolist()

print(fn,fn1,fn2)

fname = "datasets/facades1/test/" + fn[0].replace(":","_") + "sk.png"

if len(fn[0])<16:

fname = fname.replace("sk.png"," 00_00_00sk.png")

img.save(fname)

countloop=countloop+1

if countloop> COUNT:

break

else:

continue

break

else:

continue

break

Test

python test.py --dataroot ./datasets/facades1 --name facades_pix2pix1 --model pix2pix --direction AtoB

BackTest.py

import torch

from torchvision import transforms

from torchvision.datasets import ImageFolder

import os

from PIL import Image

import matplotlib.pyplot as plt

get_ipython().run_line_magic('matplotlib', 'inline')

import numpy as np

import pdb

import re

import os

os.environ['KMP_DUPLICATE_LIB_OK']='True'

path = os.getcwd()

new_dir_path = "results/facades_pix2pix1/test_latest/images"

img=[]

image={}

for imageName in os.listdir(new_dir_path):

inputPath = os.path.join(path, new_dir_path,imageName)

if "fake_B" in imageName : image['fakeB']=inputPath

if "real_A" in imageName: image['realA']=inputPath

if "real_B" in imageName: image['realB']=inputPath

if len(image)==3:

ddd=re.findall(r"\d\d\d\d-\d\d-\d\d \d\d_\d\d_\d\d",inputPath)

try:

image['date']=ddd[0].replace("_",":")

img.append(image)

image={}

except:

pass

# In[36]:

import re

import datetime

def min_max(x, axis=None):

min = x.min(axis=axis, keepdims=True)

max = x.max(axis=axis, keepdims=True)

result = (x-min)/(max-min)

return result

def getprice(img,transform,info):

#match = re.search(r'\d{4}-\d{2}-\d{2}', img['fakeB'])

#date = datetime.datetime.strptime(match.group(), '%Y-%m-%d').date()

fake = transform(Image.open(img['fakeB']))

fake=fake.numpy()

fake1x = fake[info,:,0]

fake1y = fake[info,0,:]

fake2=(fake1x+fake1y)/2

return min_max(fake2),img['date']

# In[165]:

def GetSignal(item):

y1 = np.mean(item[128:192])

y2 = np.mean(item[192:256])

return y2/y1

# In[166]:

import matplotlib.animation as animation

get_ipython().run_line_magic('matplotlib', 'nbagg')

import random

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.animation as animation

transform = transforms.PILToTensor()

fig = plt.figure()

ims = []

# In[167]:

import matplotlib.pyplot as plt

import pandas as pd

get_ipython().run_line_magic('matplotlib', 'inline')

from tqdm import tqdm

realdf = pd.read_csv(r'C://Users//User//Desktop//EURUSD.oj5k15.csv', sep=",",names=('date', 'time', 'Open', 'High', 'Low', 'Close', 'Volume'))

realdf.index = pd.to_datetime(realdf['date']+" "+realdf['time'])

realdf['signal']=-1

for item in img:

v2,date = getprice(item,transform,0)

signal =GetSignal(v2)

realdf.at[date, 'signal'] = signal

BackTest

シグナルは過去の平均値と、未来の平均値を割り算して閾値判定した。

6倍ぐらい(逆数は0.18)の差がついたところを、シグナルに使うのがよさそう・・・

買い 6 < signal1 < 80

売り 0.0125 < signal1 <0.18

本当は正規分布で二山ぐらいに分離した状態をエントリー判定に使うのがベターなのであるが

BackTest.py

from backtesting import Backtest, Strategy

from backtesting.lib import SignalStrategy, TrailingStrategy

import backtesting

def SIGNAL():

return realdf.signal

class pix2pix(Strategy):

def init(self):

self.signal1=self.I(SIGNAL)

pass

def next(self): #チャートデータの行ごとに呼び出される

super().next()

current_time = self.data.index[-1]

if self.signal1>6 and self.signal1<80:

#self.position.close()

self.buy() # 買い

elif self.signal1>0.0125 and self.signal1<0.18:

#self.position.close()

self.sell()# 売り

# Additionally, set aggressive stop-loss on trades that have been open

# for more than two days

for trade in self.trades:

if current_time - trade.entry_time > pd.Timedelta(30, "m"):

self.position.close()

bt = Backtest(

realdf, # チャートデータ

pix2pix, # 売買戦略

cash=100000, # 最初の所持金

commission=0.000, # 取引手数料

margin=0.5, # レバレッジ倍率の逆数(0.5で2倍レバレッジ)

trade_on_close=True, # True:現在の終値で取引,False:次の時間の始値で取引

exclusive_orders=True #自動でポジションをクローズ

)

output = bt.run() # バックテスト実行

print(output) # 実行結果(データ)

bt.plot() # 実行結果(グラフ)