Terms and Concepts

Overview of Financial Reports

- Balance Sheet

- Income Statement

- Statement of Cash Flow

Important Concepts

- Entity Concept: 必须是公司的不是个人的

- Money Measurement Concept: 必须可金钱衡量的 eg. Employees cannot be measured thus not recorded

- Going Concern Concept: 公司是长久持续的

- Consistency Concept: use the same accounting methods and procedures from period to period

- Materiality Concept: 太小的东西不用记 eg. Paper clips vs. Vans

Accrual Basis

- GAAP vs. IFRS

- Rules-based vs. Principle-based: 严格按照规则 vs. 符合大体原则(有一定的裁量余地)

- GAAP will become more principle based

The Balance Sheet 资产负债表 貸借対照表

The Accounting Equation

ASSETS = LIABILITIES + OWNERS' EQUITY

资产 = 负债 + 所有者权益

資産 + 負債 + 純資産

Important Concepts

- Dual Aspect: every accounting transaction has two sides which must be recorded

- Historical Cost: value measured based on historical costs (rather than market value)

- RELEVANCE (Market Value) vs. RELIABILITY (Historical Cost)

- While IFRS favors the historical cost model, it does present as an acceptable alternative treatment the revaluation of land and buildings to their market value, if their value can be measured reliably subsequent to their initial recognition at cost.

Important Ratios

- Current Ratio: ability to meet its current obligations

- a healthy business will have a minimum current ratio of 2 (varies by industry)

\frac{Current\,Assets}{Current\,Liabilities} = Current\,Ratio

- Total Debt to Equity Ratio: useful for judging an entity's long-term financial viability

- total debt: (include short-term debt in this course) exclude non-interest bearing current liability? eg. Account payable

\frac{Total\,Debt}{Total\,Equity} = Total\,Debt\,to\,Equity\,Ratio

The Income Statement 损益表/利润表 損益計算書

Link to Balance Sheet

- Retained Earnings (Ending Balance) 留存收益 内部留保

= Retained Earnings (Beginning Balance) + Net Income (or Loss) - Dividends - payment of dividends is not an expense thus not recorded on the income statement

Important Concepts

-

Realization Concept: when to recognize revenue

-

Two conditions must be satisfied to record a revenue: Earned(顾客已收到商品或服务) and Realized/Realizable(顾客已付钱或可预见其付钱)

-

Matching Concept: when to recognize expense

-

Recorded and Recognized = Associated directly with products and services offered for sale 售出商品的成本等=计入

-

Recorded and Recognized = Not associated directly with products and services but related to this period's activities 和商品无关的支出(工资等)=计入

-

Not Recorded or Recognized = Associated with future period revenues 库存等=不计入当期支出(计入当期库存/资产)

-

Conservatism Concept: suggest prudence in the recording of revenues/expenses (and assets/liabilities)

-

revenues should be recognized only when reasonably certain,

-

but expenses should be recognized as soon as reasonably possible.

Important Ratios

- Gross Margin Percentage

- SG&D, interest, tax, etc. not taken into consideration (software companies tend to have higher Gross Margin Percentage because R&D expense not included)

Gross\,Margin\,Percentage = \frac{Dollar\,Gross\,Margin}{Sales} * 100%

- Return on Sales Percentage

Return\,on\,Sales = \frac{Net\,Income}{Sales} * 100%

Caveats

- Operating expense doesn't include capital expenses such as the purchase of news vans, computers, or even buildings. However, depreciation of those assets is charged to the income statement

- a company sometimes has a choice of whether to incur an operating expense or a capital expense

- Operating expense doesn't include tax and interest expense.

- *Operating cash flows do take into consideration tax and interest.

Accounting Records

Debits and Credits

| Increase | Decrease | |

|---|---|---|

| Asset Accounts | Debit | Credit |

| Liabilities and Owners' Equity accounts | Credit | Debit |

| Sales account | Credit | Debit |

| Expense accounts | Debit | Credit |

| 借 Debit 返済してもらう(别人还你的钱,资产) | ||

| 贷 Credit 預金してくれる(你要还给别人的,贷款) |

Post to Ledger, T-Accounts

Adjusting Entries and Closing Entries

- Adjusting entries: transactions not related to the goods or services sold (prepaid expenses, depreciation, amortization, interests, taxes...)

- Closing entries: close or reset all sales and expense accounts to zero balance (also update the balance sheet and income statement)

Cash Flow Statement

- Operating Activities

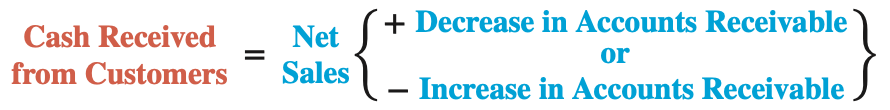

- cash received from customers

- cash paid to suppliers

- cash paid to employees

- interested paid or received

- taxes paid

- Investing Activities

- cash received from disposal of long-lived assets

- cash paid to purchase long-lived assets

- Financing Activities

- cash raised from issuance of debt or stock

- cash used to retire debt or stock

- cash used to pay dividends

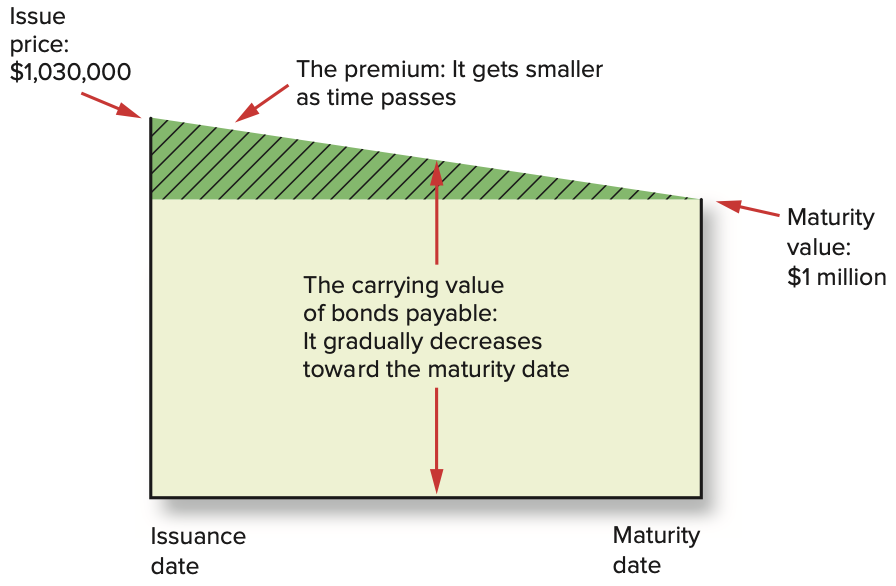

Direct Method vs. Indirect Method

- Differences in how to record Operating Activities

- Indirect Method: begins with Net Income and de-accrues changes in current assets and current liabilities other than cash and short-term debt

- De-Accrual: add increases in liabilities and decreases in assets, subtract decreases in liabilities and increases in assets $Net, Income , ADD: Increase,in,accounts,payable,,Depreciation;,SUBTRACT:,Increase,in,inventories,,Increases,in,accounts,receivable$

- Why the indirect method: it explains the difference between the net income and the operating cash flows of the period

- Why the indirect method: it explains the difference between the net income and the operating cash flows of the period

- Direct Method:

Interest/Income Tax Paid = Interest/Income Tax Expense - Increase in related accured liability (or + decrease)

Interest/Income Tax Paid = Interest/Income Tax Expense - Increase in related accured liability (or + decrease)

Revenue and Receivables

Deferred Revenue/Unearned Revenue

Deferred revenue is future revenue that has already been collected but has yet to be earned. It is shown in the liabilities section of the balance sheet.

- magazine subscriptions (before delivery)

- unredeemed gift cards

- advanced sales of airline tickets, sports/event tickets

- prepaid coupon tickets

Bad Debts

- Set up an allowance account & record bad debt expense

- It's a contra account against AR (like depreciation & amortization)

- Treated as a liability account, credit = increase, debit = reduce

- Reduce AR and Retained Earnings. Increase operating expenses, thus reduce operating income.

- Write-offs

- Debit entry to the Allowance account and credit entry to the AR account

- No change would be made in the balance sheet (total AR remains the same since bad debt allowance is already deducted from the AR)

Refunds

- Set up an allowance account for sales returns

- it's a liability account

- reduce Retained Earnings of the same amount. also reduce Gross Sales of the same amount

- Actual Returns

- reduce cash and allowance.

Prompt Payment/Cash Discount

- Set up an allowance for cash discount account.

- it's a liability account

- reduce Retained Earnings of the same amount. also reduce Gross Sales of the same amount

- it's different from a sales discount

- Cash Collection

- increase Cash, reduce Allowance and AR(=cash+allowance)

Month-end Adjustment

- Update the account with new estimations +/- the error for

- Overestimations

- Underestimations

Ratios

- Bad Debt Ratio:

BAD\,DEBT\,RATIO = \frac{Bad\,debt\,allowances\,at\,the\,end\,of\,the\,period}{Gross\,receivables\,at\,the\,end\,of\,the\,period} \, \times \,100\%

- Days Receivable Ratio

DAYS\,RECEIVABLE = \frac{Net\,accounts\,receivable}{Total\,sales\,in\,the\,period} \, \times \,\, no.of\,days\,in\,the\,period

Inventories and Cost of Sales

Accounting records keep track of the flow of the inventory cost, not the flow of the physical inventory items.

COST\,OF\,GOODS\,SOLD = Beginning\,inventory + pruchases - ending\,inventory

Bought Inventory vs. Manufactured Inventory

- Three inventory accounts:

- raw materials

- working-in-process (WIP)

- finished goods

- Cost Included: Labor, Materials, Manufacturing Overhead

- Cost Excluded: Advertising, office cleaning, operating, etc.

Price Change

- FIFO or LIFO: Company choose based on taxes (IFRS does not permit LIFO)

- LIFO reserve - the cost difference between FIFO and LIFO inventory

- In periods with rising prices and increasing quantities of inventories, FIFO has a higher inventory balance and a higher net income than LIFO.

Inventory Write-down

Lower of Cost or Market: increase(debit) COGS, and reduce(credit) Inventory

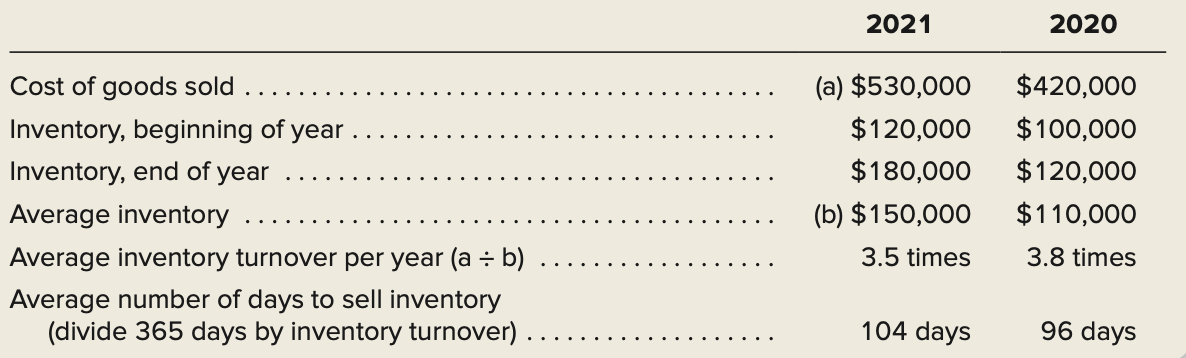

Inventory Ratios:

Inventory\,Turnover = \frac{Cost\,of\,Goods\,Sold}{Average\,Inventory}\\

Average\,Inventory = \frac{Beginning\,inventory + Ending\,inventory}{2}\\

Days\,Inventory = 365 \div \frac{Cost\,of\,Goods\,Sold}{Average\,Inventory}

Depreciation and Non-Current Assets

-Tangible Assets

-Intangible Assets

Acquisition Cost

- Capitalization: Costs associated with the acquisition of the asset that are incurred in bringing the asset to its intended location and to get it ready for use are "capitalized", i.e. included as part of the total cost of the asset that appears on the balance sheet.

- E.g. the cost to deliver and install a machine, the realtor's fee and cleaning cost of purchasing a land

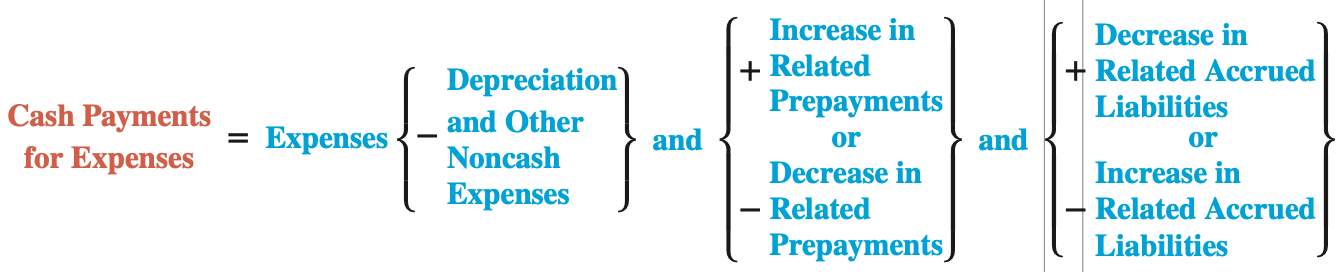

Depreciation

- Appears as a contra asset account associated with the particular asset.

- For assets used to manufacture products, the depreciation expense is charged to WIP Inventory and subsequently transferred to Finished Goods Inventory and eventually to Cost of Sales.

- For assets not used in production, it is charged to Operating Expenses or

General & Administrative Expenses.

Methods:

- Straight-line Depreciation:

\frac{Asset\,Cost - Estimated\,Salvage\,Value}{Estimated\,Years\,of\,Useful\,Asset\,Life}

- Accelerated Depreciation:(double-declining balance method (DDB) )

- Notice that, in contrast to the straight-line method, DDB depreciation does not directly allow for an asset's expected salvage value. Instead, the asset continues to be depreciated until its book value equals its salvage value, at which point no further depreciation expense is recorded.

\frac{2}{Estimated\,Years\,of\,Useful\,Asset\,Life} \times Asset's\,Beginning\,Book\,Value

Improvements

- the cost of any improvements or "betterment" to an existing asset must be capitalized (add to the asset value). E.g. Add a sunroof to a car

- improvements are not the same as repair or maintenance costs, which are recorded as an expense and cannot be capitalized. E.g. changing a car's oil or perform a regular check-up

Assets Sales

- At the time of sale, any difference between the sales price and the book value of the asset is recorded as either a gain or a loss.

- Gains and losses are generally included in the "Other Income", under Operating Expenses or General & Administrative Expenses.

Intangibles

- The costs of filing a patent can be viewed as an intangible asset and are capitalized.

- R&D costs of obtaining the asset cannot be capitalized.

- Amortization:

- estimated using the straight-line method

- no contra-asset account is created. directly credited to the intangible asset itself.

Ratios

Return on Assets (Long-lived Asset Turnover):

(how quickly the firm is able to generate revenues from the use of long-lived assets)

\frac{Revenues}{Average\,LongLived\,Assets}

Liabilities and Financing Costs

Zero Coupon Debt

The borrower agrees to pay the lender a fixed amount in the future in return for receiving an amount today that is less than the future payment. The borrower is also relieved from having to make periodic interest payments to the lender.

- initially, recorded as a liability at the amount received

- in each subsequent accounting period, calculate accrued interest (at the rate implied by the agreement) and record as an expense and an addition to the loan liability balance

Leases

Capital Lease or Operating Lease?

Under GAAP, a lease arrangement is classified as a capital lease if one of the following criteria are met:

-Ownership of the leased asset is transferred to the lessee at the end of the lease term.

-The lessee has an option to purchase the leased asset at a bargain purchase price.

-The term of the lease is 75 percent or more of the leased asset's economic life (i.e., its productive life).

-The present value of the lease payments discounted by the lessee's borrowing cost is 90 percent or more of the fair value of the property.

- Capital Lease

- Calculate present value of total lease payment

- calculate interest rate of each period (based on the beginning of the period obligation balance)

- calculate obligation repayment of the period and end of period obligation balance

- calculate capital lease asset depreciation using staright-line model based on the orginial cost of lease payment

- calculate capital lease asset depreciation using staright-line model based on the orginial cost of lease payment

- Operating Lease

The accounting for an operating lease is straightforward. The periodic lease payments are simply recorded as a lease expense each year. Neither a liability nor an asset is recognized.

Contingent Liabilities

A loss contingency is recognized as a liability when both of the following conditions are met.

- Information available prior to the issuance of the financial statements indicates that it is probable that an asset has been impaired or a liability has been incurred (That is, the three liability criteria have been met).

- The amount of the loss can be reasonably estimated.

Future Event Confirm?

- Yes

- Probable: Recognize and disclose the loss contingency as a liability

- Reasonably Possible: Disclose only

- Remote: Do nothing

- No: Do nothing

Debt Ratings

Important Ratio:

EBITDA\,Coverage\,Ratio = \frac{EBITDA}{Total\,interest\,charges}

The higher the ratio, the higher the rating is.

Bonds Payable

-

Issuance of bonds payable: use underwriter

-

Type of bonds

- mortgage bonds: secured by assets

- debenture bonds: not secured

- callable: the corporation has the right to redeem the bonds in advance of the maturity date (with a higher call price)

- convertible bond: exchangeable for stocks

- junk bonds

-

If interest rates rise, the market price of existing bonds will fall; if interest rates decline, the price of bonds will rise.

-

If the price of a bond is above maturity value, the yield rate is less than the bond interest rate; if the price of a bond is below maturity value, the yield rate is higher than the bond interest rate.

- because if the bond price is lower than the face value, it means that the bond coupon rate is lower than the interest rate, thus need to lower its price to provide a higher yield rate to compensate for the loss for investors.

-

Tax advantage: interest payments are deductible; dividends are not (better issuing bond than stock)

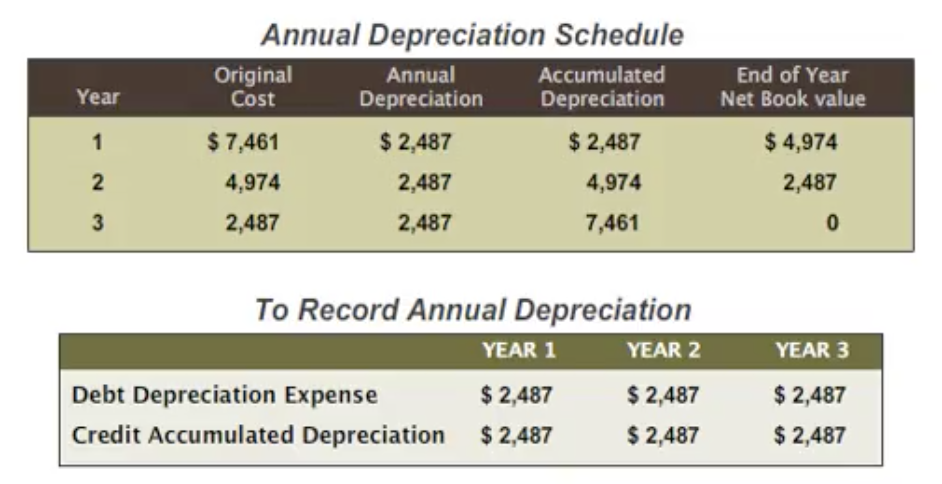

Bond Amortization

- If bond issued at a discount (or at a premium), the cash received at issuance is less (or more) than the face value of the bond.

- Then the firm needs to record a Discount on Bond Payable (or a Premium on Bond Payable), and gradually amortize it so its liability of net bond payable carrying value increases (or decreases) over the term of the bond.

- two ways to amortize

Investments and Investment Income

Investment Motivations: for short-term money value (Marketable Securities) or long-term control (Business Acquisitions)

Marketable Securities

-Readily marketable

-Expected to be converted to cash within a year

-Have no control implications for the company whose securities are acquired

Accounting method differs depending on the intent:

- Hold-to-Maturity: accounted for on the balance sheet at their cost

- Trading: accounted for at their market value

- at each balance sheet date they are reported at their current market value.

- Any unrealized gain or loss since the last balance sheet date is included in the income statement as investment income.

- When the security is eventually sold, any additional gains or loss is also recorded in the income statement as investment income.

- Available-for-Sale

- reported on the balance sheet at their market value.

- However, unlike the case of trading securities, unrealized gains and losses on available-for-sale securities are not shown as Investment Income. Instead, they are directly credited/debited to a special shareholders' equity account called Unrealized gains and losses on Available-for-Sale Securities.

- When the security is sold and an actual gain or loss is realized, any related unrealized gain or loss recognized to date is eliminated from owners' equity and the actual gain or loss is recorded in the income statement.

Business Acquisitions

- Purchase Price:

- Purchase price = Identifiable Net Assets Fair Value (= Fair value of assets acquired - Fair value of liabilities assumed) + Goodwill

- Balance sheet: add all acquired assets and liabilities plus goodwill, and

record any liabilities or equities used for financing the acquisition.

Goodwill

- Based on the acquirers' purchase price, goodwill can be thought of representing the value of the acquired company's earning power in excess of the earning power of the acquired net assets standing alone.

- goodwill is an intangible asset. However, it is not amortized. Instead, it is tested annually for impairment and, if impaired, the decline in the value of the asset is reflected on the balance sheet and an expense for the amount of the impairment appears on the income statement.

Deferred Taxes and Tax Expense

- Due to the different accounting methods used for tax return preparation and for financial reporting purposes.

- Deferred tax accounting is used when the following three conditions hold:

- A transaction or event is accounted for differently in an entity's financial reports and income tax returns.

- The accounting effect of the difference in accounting policies is temporary in that the early period effects of the difference are reversed in later periods.

- The accounting difference has tax consequences.

Deferred Tax Liability

Tax Expense > Tax Due, Deferred Tax Liability (E.g. Depreciation)

Deferred Tax Asset

Tax Due > Tax Expense, Deferred Tax Asset (E.g. Bad debt)

Loss Carryforwards -> Deferred Tax Asset

Current and Deferred Tax Expense

The tax expense in a firm's income statement can be divided into two components,

- the current portion and

- the deferred portion.

Owner's Equity

Common Stock

Paid-in Capital = Par Value + Additional Paid-in Capital

Preferred Stock

- Preferred stock is less risky than common stock since it has higher priority in receiving dividend payments and return of capital in the event of a liquidation of the company.

- Preferred stock does not have voting rights.

- Preferred stock is typically entitled to a fixed dividend rate, comparable to fixed interest debt. In contrast, common stock is not entitled to any specified dividend payment.

Stock Repurchases

- called Treasury Stock

- The Treasury Stock account is deducted from shareholder's equity

- Stock repurchases enable some investors to receive cash in a form that leads to a capital gain, which is typically taxed at capital gains rate that is lower than the rate used to tax ordinary income. This tax difference has led many companies to make distributions to shareholders in the form of a stock repurchase rather than a dividend.

Dividends

- Some firms decide to pay out cash to shareholders as dividends, some firms avoid paying dividends to focus on growth

- The stocks of firms that pay dividends are called income stocks. Investors attracted to income stocks include:

- Retired investors who want a steady stream of income, and

- Institutions that do not pay taxes on dividends

- Reduce Retained Earnings, credit Dividends Payable (or Cash eventually)

Stock Splits

- A split changes the number of shares owned by its current shareholders, but does not change the book values of the firm's assets, liabilities, or its owners' equity.

- Stock splits signal that management confidence in the firm's future prospects, or by making it less costly for small investors to own small parcels of shares.

- For accounting, update the par value on the balance sheet

Stock Options

- If a company grants a stock option to a manager, the manager has the right to buy the stock from the company at a specified price, called the exercise or strike price, within a specified period, called the exercise period. (it's not granting the stock right away. instead, allow the manager to buy the stock at a fixed price in the future)

- need to calculate the fair value of stock options

Comprehensive Income

- The Comprehensive Income Statement shows changes in shareholders equity arising from all changes other than new investments by or distributions to owners

- Because the Income Statement does not include all changes in Owners' Equity, standard setters now require firms to prepare a Comprehensive Income Statement to provide investors with such a reconciliation.

Equity Ratios

\begin{align}

Return\,on\,Equity &= \frac{Net\,Income}{Owners'\,Equity}\\

&= \frac{Net\,Income}{Sales} \times \frac{Sales}{Total\,Assets} \times \frac{Total\,Assets}{Owners'\,Equity}\\

&= Net\,Income\,Margin \times Asset\,Turnover \times \,Financial\,Leverage

\end{align}

- This implies that a firm can improve its ROE by (a) increasing net income margins though improved pricing or cost controls, (b) increasing asset turnover, by reducing its working capital needs or making long-term assets work more productively, or (c) by increasing the firm's financial leverage by taking on additional debt financing.

Financial Statement Analysis

General Tools of Analysis

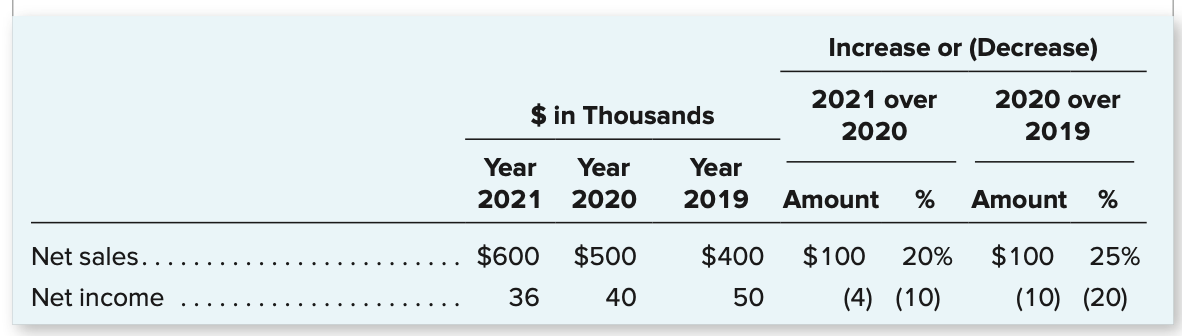

- Dollar and Percentage Changes

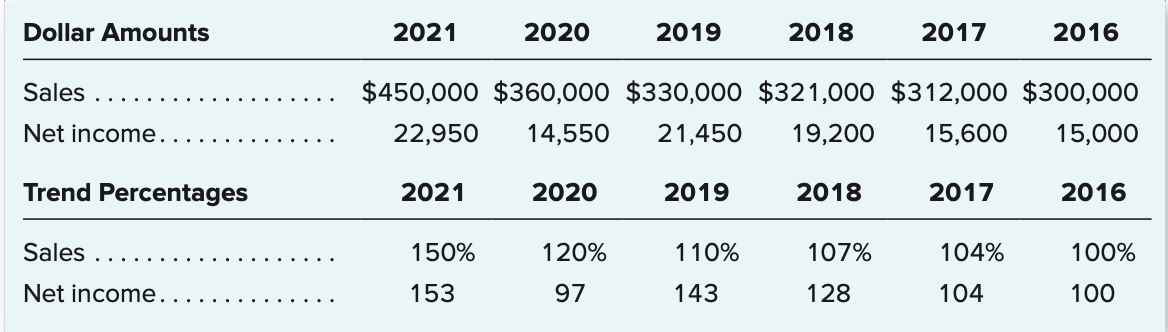

- Trend Percentages

- Trend Percentages

- Component Percentages

- Component Percentages

Measures of Liquidity and Credit Risk

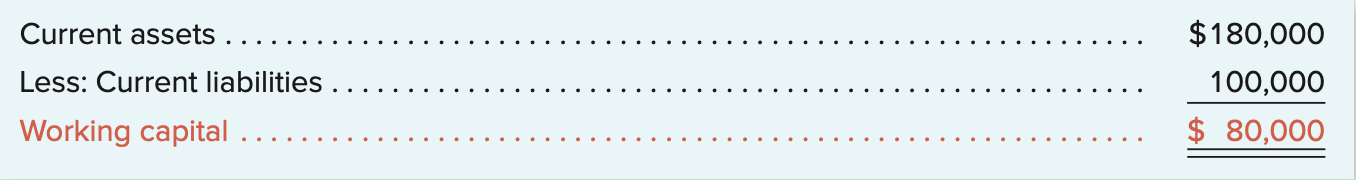

- Working Capital

- Working capital measures a company’s ability to satisfy its current liabilities from existing liquid assets. A useful way to think about working capital is that it represents a “cushion” between a com- pany’s most liquid assets and the liabilities that will require the use of those assets when the liabilities are paid.

- Current Ratio

- The higher the current ratio, the more liquid the company appears to be.

- A strong current ratio provides considerable evidence that a company will be able to meet its obligations coming due in the near future.

- Current Ratio

- The higher the current ratio, the more liquid the company appears to be.

- A strong current ratio provides considerable evidence that a company will be able to meet its obligations coming due in the near future.

- Quick Ratio

- the quick ratio compares only the most liquid current assets—called quick assets with current liabilities

- some short-term creditors prefer the quick ratio (sometimes called the acid-test ratio) to the current ratio as a measure of short-term liquidity

- Quick Ratio

- the quick ratio compares only the most liquid current assets—called quick assets with current liabilities

- some short-term creditors prefer the quick ratio (sometimes called the acid-test ratio) to the current ratio as a measure of short-term liquidity

- Debt Ratio

- The debt ratio is not a measure of short-term liquidity. Rather, it is a measure of creditors’ long-term risk.

- From the creditors’ point of view, the lower the debt ratio, the safer their position.

- Debt Ratio

- The debt ratio is not a measure of short-term liquidity. Rather, it is a measure of creditors’ long-term risk.

- From the creditors’ point of view, the lower the debt ratio, the safer their position.

- Standards for Comparison

- internal: the trend in the ratio over a period of years for the specific company

- external: compare a company’s financial ratios with those of similar companies and with industrywide averages

- industry information: Dun & Bradstreet, Inc., Media General Financial Services

### Measures of Profitability

- Price-Earnings Ratio (P/E Ratio)

- The p/e ratio reflects investors’ expectations concerning the company’s future perfor- mance. The more optimistic these expectations, the higher the p/e ratio is likely to be.

- Standards for Comparison

- internal: the trend in the ratio over a period of years for the specific company

- external: compare a company’s financial ratios with those of similar companies and with industrywide averages

- industry information: Dun & Bradstreet, Inc., Media General Financial Services

### Measures of Profitability

- Price-Earnings Ratio (P/E Ratio)

- The p/e ratio reflects investors’ expectations concerning the company’s future perfor- mance. The more optimistic these expectations, the higher the p/e ratio is likely to be.

- Return on Investment (ROI)

- evaluating the prof- itability of a business

- Return on Assets

- measures the efficiency with which management has utilized the assets under its control, regardless of whether these assets were financed with debt or equity capital

- Return on Assets

- measures the efficiency with which management has utilized the assets under its control, regardless of whether these assets were financed with debt or equity capital

- Return on Equity

- looks only at the return earned by management on the stockholders’ investment

- Return on Equity

- looks only at the return earned by management on the stockholders’ investment

- Operating Expense Ratio

- operating expense ratio is often used as a measure of management’s ability to control its operating expenses

- Operating Expense Ratio

- operating expense ratio is often used as a measure of management’s ability to control its operating expenses

- Debt Ratio

- one indicator of the amount of leverage used by a business is the debt ratio

- Debt Ratio

- one indicator of the amount of leverage used by a business is the debt ratio

- Interest Coverage Ratio

- A common measure of creditors’ safety

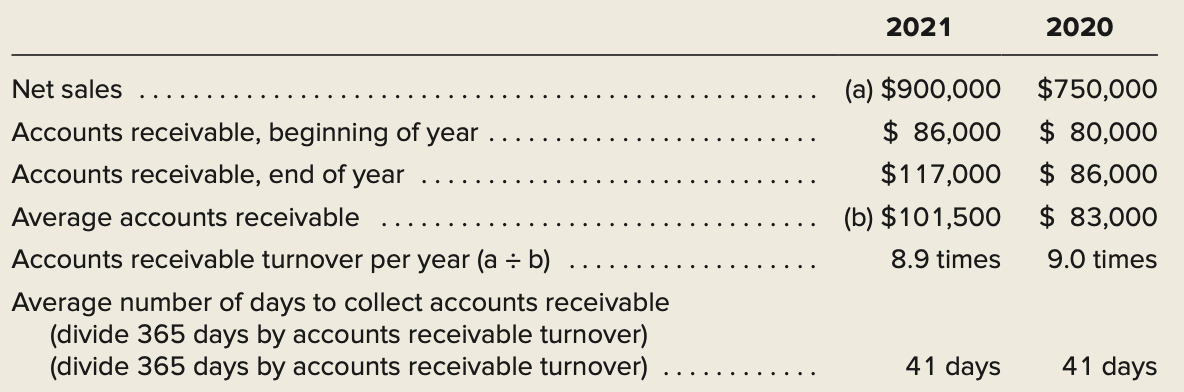

- Accounts Receivable Turnover Rate

- the accounts receivable turnover rate indicates how quickly a company converts its accounts receivable into cash (how liquid the AR is)

- Inventory Turnover Rate

- indicates how many times during the year the company is able to sell a quantity of goods equal to its average inventory. (how liquid the inventory is)

- Companies with low gross profit rates often need high inventory turnover rates in order to operate profitably. Companies that sell high markup items, such as jewelry stores and art galleries, can operate success- fully with much lower inventory turnover rates.

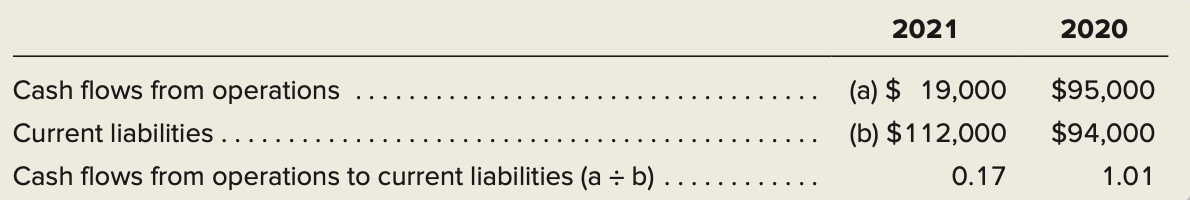

- Cash Flows from Operations to Current Liabilities

- This measure provides evidence of the company’s ability to cover its currently maturing liabilities from normal operations.

-

Cash Conversion Cycle

- Cash Conversion Cycle = Days in Inventory + Days in Receivables – Days in Payables

-

Cash Flow to Net Income Ratio

-

USEFULNESS OF NOTES TO FINANCIAL STATEMENTS

- Accounting policies and methods.

- Unused lines of credit.

- Significant commitments and loss contingencies.

- Current values of financial instruments (if different from the carrying values shown in the statements).

- Dividends in arrears.

- Concentrations of credit risk.

- Assets pledged to secure specific liabilities