『経済・ファイナンスデータの計量時系列分析』

の章末問題で「コンピュータを用いて」とあるものをRで解いています。

Rで計量時系列分析:VARモデルから個々の時系列データ間の因果関係を推定するを参考にさせていただいた。

4.5

- (1) 表4.1

library(vars)

msci_day<-read.table("msci_day.txt",header=T)

# table4.1

msci_jp.p<-diff(log(msci_day$jp))*100

msci_uk.p<-diff(log(msci_day$uk))*100

msci_us.p<-diff(log(msci_day$us))*100

msci_jp_uk<-data.frame(cbind(msci_jp.p, msci_uk.p))

names(msci_jp_uk)<-c("jp", "uk")

VARselect(msci_jp_uk)

$selection

AIC(n) HQ(n) SC(n) FPE(n)

3 1 1 3

$criteria

1 2 3 4 5 6 7 8 9 10

AIC(n) 0.3902466 0.3875176 0.3874987 0.3925397 0.3900660 0.3906680 0.3946727 0.3977254 0.3958429 0.3983227

HQ(n) 0.3987528 0.4016947 0.4073466 0.4180584 0.4212555 0.4275283 0.4372038 0.4459273 0.4497157 0.4578663

SC(n) 0.4129850 0.4254150 0.4405550 0.4607550 0.4734402 0.4892012 0.5083648 0.5265765 0.5398529 0.5574917

FPE(n) 1.4773451 1.4733191 1.4732913 1.4807372 1.4770793 1.4779694 1.4839009 1.4884389 1.4856410 1.4893315

msci_jp_uk.var<-VAR(msci_jp_uk,p=3)

summary(msci_jp_uk.var)

VAR Estimation Results:

=========================

Endogenous variables: jp, uk

Deterministic variables: const

Sample size: 1387

Log Likelihood: -4191.851

Roots of the characteristic polynomial:

0.4821 0.3647 0.3647 0.3208 0.3208 0.2654

Call:

VAR(y = msci_jp_uk, p = 3)

Estimation results for equation jp:

===================================

jp = jp.l1 + uk.l1 + jp.l2 + uk.l2 + jp.l3 + uk.l3 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 -0.13654 0.02786 -4.901 1.07e-06 ***

uk.l1 0.42950 0.03268 13.143 < 2e-16 ***

jp.l2 -0.07311 0.02804 -2.607 0.00923 **

uk.l2 0.09295 0.03529 2.634 0.00853 **

jp.l3 -0.03010 0.02611 -1.153 0.24911

uk.l3 0.04430 0.03470 1.277 0.20197

const 0.03042 0.03268 0.931 0.35218

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.213 on 1380 degrees of freedom

Multiple R-Squared: 0.117, Adjusted R-squared: 0.1131

F-statistic: 30.46 on 6 and 1380 DF, p-value: < 2.2e-16

Estimation results for equation uk:

===================================

uk = jp.l1 + uk.l1 + jp.l2 + uk.l2 + jp.l3 + uk.l3 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 -0.0146396 0.0237612 -0.616 0.537923

uk.l1 -0.1005008 0.0278722 -3.606 0.000322 ***

jp.l2 -0.0092070 0.0239193 -0.385 0.700357

uk.l2 0.0573500 0.0301004 1.905 0.056950 .

jp.l3 0.0006251 0.0222692 0.028 0.977609

uk.l3 -0.0591019 0.0295968 -1.997 0.046032 *

const 0.0499850 0.0278742 1.793 0.073154 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.034 on 1380 degrees of freedom

Multiple R-Squared: 0.02038, Adjusted R-squared: 0.01612

F-statistic: 4.784 on 6 and 1380 DF, p-value: 7.721e-05

Covariance matrix of residuals:

jp uk

jp 1.4703 0.3345

uk 0.3345 1.0696

Correlation matrix of residuals:

jp uk

jp 1.0000 0.2668

uk 0.2668 1.0000

uk_jp.granger<-causality(msci_jp_uk.var,cause="uk")$Granger

jp_uk.granger<-causality(msci_jp_uk.var,cause="jp")$Granger

msci_jp_us<-data.frame(cbind(msci_jp.p, msci_us.p))

names(msci_jp_us)<-c("jp", "us")

VARselect(msci_jp_us)

$selection

AIC(n) HQ(n) SC(n) FPE(n)

3 2 2 3

$criteria

1 2 3 4 5 6 7 8 9 10

AIC(n) 0.01461004 -0.008767984 -0.009367858 -0.005606025 -0.003056226 -0.006456374 -0.003083306 -0.002622352 -0.00207798 0.001241809

HQ(n) 0.02311628 0.005409070 0.010480018 0.019912672 0.028133293 0.030403966 0.039447856 0.045579632 0.05179483 0.060785436

SC(n) 0.03734847 0.029129398 0.043688477 0.062609263 0.080318015 0.092076820 0.110608841 0.126228748 0.14193207 0.160410815

FPE(n) 1.01471731 0.991270405 0.990676056 0.994410027 0.996949113 0.993565531 0.996923149 0.997383570 0.99792765 1.001247285

msci_jp_us.var<-VAR(msci_jp_us,p=3)

summary(msci_jp_us.var)

VAR Estimation Results:

=========================

Endogenous variables: jp, us

Deterministic variables: const

Sample size: 1387

Log Likelihood: -3921.058

Roots of the characteristic polynomial:

0.3662 0.3662 0.3112 0.2847 0.2847 0.2166

Call:

VAR(y = msci_jp_us, p = 3)

Estimation results for equation jp:

===================================

jp = jp.l1 + us.l1 + jp.l2 + us.l2 + jp.l3 + us.l3 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 -0.12668 0.02694 -4.703 2.82e-06 ***

us.l1 0.62892 0.03649 17.234 < 2e-16 ***

jp.l2 -0.08717 0.02671 -3.264 0.00113 **

us.l2 0.25234 0.04054 6.224 6.43e-10 ***

jp.l3 -0.03088 0.02433 -1.269 0.20457

us.l3 0.10262 0.04009 2.560 0.01058 *

const 0.02469 0.03132 0.788 0.43058

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.162 on 1380 degrees of freedom

Multiple R-Squared: 0.1885, Adjusted R-squared: 0.185

F-statistic: 53.42 on 6 and 1380 DF, p-value: < 2.2e-16

Estimation results for equation us:

===================================

us = jp.l1 + us.l1 + jp.l2 + us.l2 + jp.l3 + us.l3 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 0.013212 0.019898 0.664 0.507

us.l1 -0.111843 0.026959 -4.149 3.55e-05 ***

jp.l2 -0.001773 0.019731 -0.090 0.928

us.l2 -0.031419 0.029951 -1.049 0.294

jp.l3 0.004470 0.017970 0.249 0.804

us.l3 0.008875 0.029616 0.300 0.764

const 0.033431 0.023135 1.445 0.149

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8587 on 1380 degrees of freedom

Multiple R-Squared: 0.01275, Adjusted R-squared: 0.00846

F-statistic: 2.971 on 6 and 1380 DF, p-value: 0.006924

Covariance matrix of residuals:

jp us

jp 1.3512 0.0883

us 0.0883 0.7373

Correlation matrix of residuals:

jp us

jp 1.00000 0.08846

us 0.08846 1.00000

us_jp.granger<-causality(msci_jp_us.var,cause="us")$Granger

jp_us.granger<-causality(msci_jp_us.var,cause="jp")$Granger

msci_uk_us<-data.frame(cbind(msci_uk.p, msci_us.p))

names(msci_uk_us)<-c("uk", "us")

VARselect(msci_uk_us)

$selection

AIC(n) HQ(n) SC(n) FPE(n)

3 2 2 3

$criteria

1 2 3 4 5 6 7 8 9 10

AIC(n) -0.6108435 -0.6352794 -0.6374497 -0.6360516 -0.6355264 -0.6329052 -0.6315587 -0.6267474 -0.6221105 -0.6240250

HQ(n) -0.6023373 -0.6211024 -0.6176018 -0.6105329 -0.6043369 -0.5960448 -0.5890276 -0.5785454 -0.5682377 -0.5644814

SC(n) -0.5881051 -0.5973820 -0.5843933 -0.5678363 -0.5521522 -0.5343720 -0.5178666 -0.4978963 -0.4781004 -0.4648560

FPE(n) 0.5428927 0.5297875 0.5286390 0.5293787 0.5296569 0.5310474 0.5317632 0.5343283 0.5368122 0.5357861

msci_uk_us.var<-VAR(msci_uk_us,p=3)

summary(msci_uk_us.var)

VAR Estimation Results:

=========================

Endogenous variables: uk, us

Deterministic variables: const

Sample size: 1387

Log Likelihood: -3484.284

Roots of the characteristic polynomial:

0.4796 0.3646 0.3646 0.2949 0.2949 0.1073

Call:

VAR(y = msci_uk_us, p = 3)

Estimation results for equation uk:

===================================

uk = uk.l1 + us.l1 + uk.l2 + us.l2 + uk.l3 + us.l3 + const

Estimate Std. Error t value Pr(>|t|)

uk.l1 -0.32624 0.03053 -10.687 < 2e-16 ***

us.l1 0.49923 0.03424 14.579 < 2e-16 ***

uk.l2 -0.04092 0.03164 -1.293 0.19612

us.l2 0.19095 0.03817 5.003 6.38e-07 ***

uk.l3 -0.08355 0.02833 -2.949 0.00324 **

us.l3 0.08628 0.03650 2.364 0.01823 *

const 0.03980 0.02593 1.535 0.12508

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.9624 on 1380 degrees of freedom

Multiple R-Squared: 0.1516, Adjusted R-squared: 0.148

F-statistic: 41.11 on 6 and 1380 DF, p-value: < 2.2e-16

Estimation results for equation us:

===================================

us = uk.l1 + us.l1 + uk.l2 + us.l2 + uk.l3 + us.l3 + const

Estimate Std. Error t value Pr(>|t|)

uk.l1 -0.0005434 0.0272247 -0.020 0.984079

us.l1 -0.1095305 0.0305391 -3.587 0.000347 ***

uk.l2 0.0028284 0.0282209 0.100 0.920181

us.l2 -0.0249528 0.0340429 -0.733 0.463695

uk.l3 -0.0302226 0.0252635 -1.196 0.231787

us.l3 0.0240891 0.0325552 0.740 0.459460

const 0.0346515 0.0231299 1.498 0.134330

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.8583 on 1380 degrees of freedom

Multiple R-Squared: 0.01356, Adjusted R-squared: 0.009271

F-statistic: 3.162 on 6 and 1380 DF, p-value: 0.004393

Covariance matrix of residuals:

uk us

uk 0.9262 0.3948

us 0.3948 0.7367

Correlation matrix of residuals:

uk us

uk 1.0000 0.4779

us 0.4779 1.0000

uk_us.granger<-causality(msci_uk_us.var,cause="uk")$Granger

us_uk.granger<-causality(msci_uk_us.var,cause="us")$Granger

out<-data.frame(matrix(c(uk_jp.granger$statistic[1],

us_jp.granger$statistic[1],

jp_uk.granger$statistic[1],

us_uk.granger$statistic[1],

jp_us.granger$statistic[1],

uk_us.granger$statistic[1]),nrow=1))

out<-rbind(out, c(uk_jp.granger$p.value,

us_jp.granger$p.value,

jp_uk.granger$p.value,

us_uk.granger$p.value,

jp_us.granger$p.value,

uk_us.granger$p.value))

colnames(out)<-c("UK->JP", "US->JP", "JP->UK", "US->UK", "JP->US", "UK->US")

rownames(out)<-c("検定統計量","P値")

out

UK->JP US->JP JP->UK US->UK JP->US UK->US

検定統計量 58.79556 104.5269 0.1614905 71.36158 0.1720271 0.5486038

P値 0.00000 0.0000 0.9222796 0.00000 0.9153345 0.6490908

……、本のp83 表4.1と合わないですね、…… 誤り分かる方ご指摘下さい。

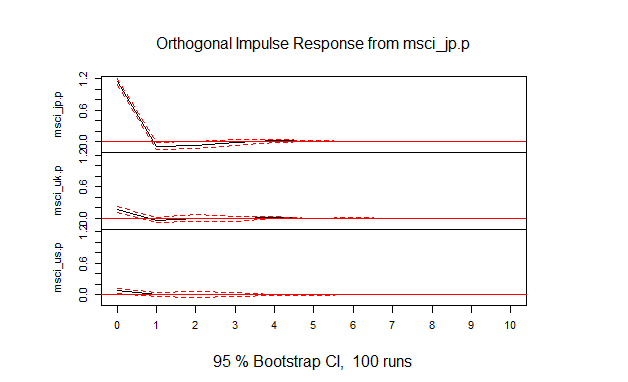

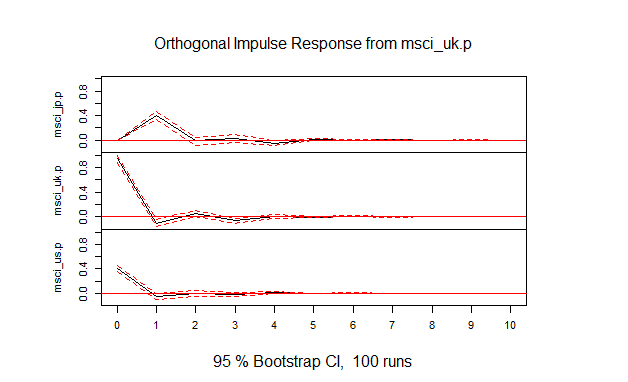

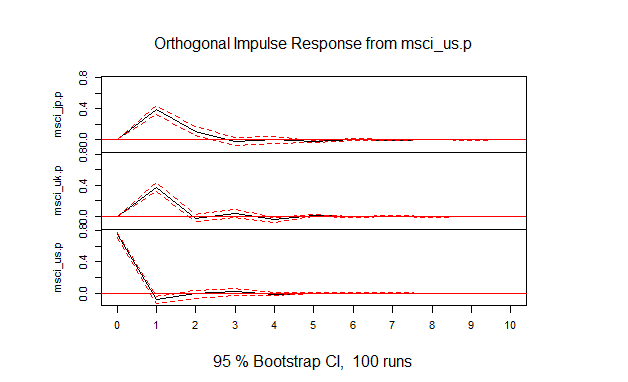

- (1) 図4.1

msci_jp_uk_us<-data.frame(cbind(msci_jp.p, msci_uk.p, msci_us.p))

VARselect(msci_jp_uk_us)

msci.var<-VAR(msci_jp_uk_us,p=3)

msci.irf<-irf(msci.var,ci=0.95)

plot(msci.irf)

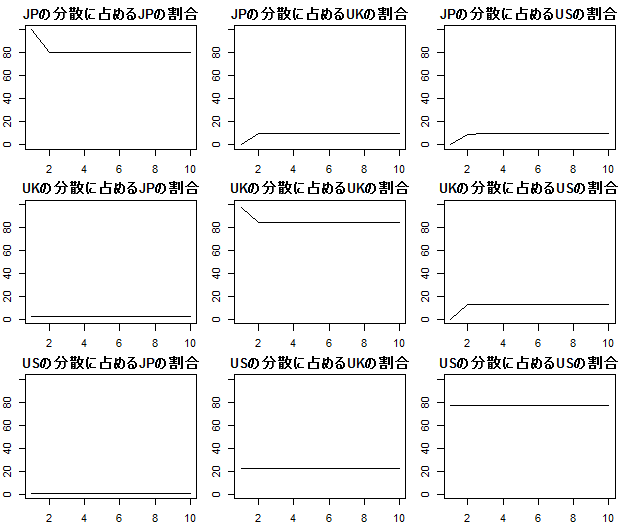

- (1) 図4.2

msci.fevd<-fevd(msci.var)

par(mfrow=c(3,3))

par(mar=c(2, 2, 2, 1))

plot(msci.fevd$msci_jp.p[,1]*100,type="l",ylim=c(0,100),ylab="",main="JPの分散に占めるJPの割合")

plot(msci.fevd$msci_jp.p[,2]*100,type="l",ylim=c(0,100),ylab="",main="JPの分散に占めるUKの割合")

plot(msci.fevd$msci_jp.p[,3]*100,type="l",ylim=c(0,100),ylab="",main="JPの分散に占めるUSの割合")

plot(msci.fevd$msci_uk.p[,1]*100,type="l",ylim=c(0,100),ylab="",main="UKの分散に占めるJPの割合")

plot(msci.fevd$msci_uk.p[,2]*100,type="l",ylim=c(0,100),ylab="",main="UKの分散に占めるUKの割合")

plot(msci.fevd$msci_uk.p[,3]*100,type="l",ylim=c(0,100),ylab="",main="UKの分散に占めるUSの割合")

plot(msci.fevd$msci_us.p[,1]*100,type="l",ylim=c(0,100),ylab="",main="USの分散に占めるJPの割合")

plot(msci.fevd$msci_us.p[,2]*100,type="l",ylim=c(0,100),ylab="",main="USの分散に占めるUKの割合")

plot(msci.fevd$msci_us.p[,3]*100,type="l",ylim=c(0,100),ylab="",main="USの分散に占めるUSの割合")

par(mfrow=c(1,1))

par(mar=c(3,3,3,3))

4.6

library(vars)

msci_day<-read.table("msci_day.txt",header=T)

- (1)

msci_jp.p<-diff(log(msci_day$jp))*100

msci_fr.p<-diff(log(msci_day$fr))*100

msci_ca.p<-diff(log(msci_day$ca))*100

-

(2)

jpの外生性が高く以下fr, ca

jp-uk-usと時差地理的にほぼ同等なので妥当 -

(3)

外生性が高い順 -

(4)

msci_jfc<-data.frame(cbind(msci_jp.p, msci_fr.p, msci_ca.p))

names(msci_jfc)<-c("jp", "fr", "ca")

VARselect(msci_jfc)

$selection

AIC(n) HQ(n) SC(n) FPE(n)

2 1 1 2

$criteria

1 2 3 4 5 6 7

AIC(n) 0.2412037 0.2348374 0.2372172 0.2464376 0.2460225 0.2505104 0.2553570

HQ(n) 0.2582161 0.2646092 0.2797483 0.3017281 0.3140723 0.3313196 0.3489256

SC(n) 0.2866805 0.3144219 0.3509093 0.3942374 0.4279299 0.4665255 0.5054798

FPE(n) 1.2727803 1.2647034 1.2677173 1.2794615 1.2789323 1.2846877 1.2909329

8 9 10

AIC(n) 0.2619935 0.2659460 0.2719333

HQ(n) 0.3683214 0.3850333 0.4037799

SC(n) 0.5462239 0.5842841 0.6243790

FPE(n) 1.2995336 1.3046865 1.3125293

msci_jfc.var<-VAR(msci_jfc,p=2)

summary(msci_jfc.var)

VAR Estimation Results:

=========================

Endogenous variables: jp, fr, ca

Deterministic variables: const

Sample size: 1388

Log Likelihood: -6052.969

Roots of the characteristic polynomial:

0.3314 0.2705 0.2705 0.2349 0.2349 0.003481

Call:

VAR(y = msci_jfc, p = 2)

Estimation results for equation jp:

===================================

jp = jp.l1 + fr.l1 + ca.l1 + jp.l2 + fr.l2 + ca.l2 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 -0.16613 0.02771 -5.995 2.60e-09 ***

fr.l1 0.30166 0.03394 8.887 < 2e-16 ***

ca.l1 0.25645 0.03651 7.024 3.37e-12 ***

jp.l2 -0.07788 0.02561 -3.042 0.0024 **

fr.l2 0.07928 0.03485 2.275 0.0231 *

ca.l2 0.01687 0.03733 0.452 0.6513

const 0.01088 0.03186 0.342 0.7328

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.179 on 1381 degrees of freedom

Multiple R-Squared: 0.1675, Adjusted R-squared: 0.1639

F-statistic: 46.3 on 6 and 1381 DF, p-value: < 2.2e-16

Estimation results for equation fr:

===================================

fr = jp.l1 + fr.l1 + ca.l1 + jp.l2 + fr.l2 + ca.l2 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 -0.03864 0.02658 -1.454 0.1463

fr.l1 -0.15762 0.03256 -4.841 1.44e-06 ***

ca.l1 0.21916 0.03502 6.258 5.20e-10 ***

jp.l2 -0.06463 0.02456 -2.631 0.0086 **

fr.l2 0.03572 0.03343 1.068 0.2856

ca.l2 0.06986 0.03580 1.951 0.0512 .

const 0.04789 0.03056 1.567 0.1173

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.131 on 1381 degrees of freedom

Multiple R-Squared: 0.03785, Adjusted R-squared: 0.03367

F-statistic: 9.054 on 6 and 1381 DF, p-value: 9.944e-10

Estimation results for equation ca:

===================================

ca = jp.l1 + fr.l1 + ca.l1 + jp.l2 + fr.l2 + ca.l2 + const

Estimate Std. Error t value Pr(>|t|)

jp.l1 0.01591 0.02434 0.654 0.51338

fr.l1 -0.01942 0.02981 -0.652 0.51482

ca.l1 0.05925 0.03206 1.848 0.06485 .

jp.l2 -0.04301 0.02249 -1.913 0.05600 .

fr.l2 0.06311 0.03061 2.062 0.03941 *

ca.l2 -0.02857 0.03278 -0.872 0.38363

const 0.08118 0.02798 2.902 0.00377 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.035 on 1381 degrees of freedom

Multiple R-Squared: 0.008891, Adjusted R-squared: 0.004585

F-statistic: 2.065 on 6 and 1381 DF, p-value: 0.05459

Covariance matrix of residuals:

jp fr ca

jp 1.3890 0.3319 0.2132

fr 0.3319 1.2781 0.6383

ca 0.2132 0.6383 1.0714

Correlation matrix of residuals:

jp fr ca

jp 1.0000 0.2491 0.1748

fr 0.2491 1.0000 0.5455

ca 0.1748 0.5455 1.0000

(5)

causality(msci_jfc.var,cause="fr")

$Granger

Granger causality H0: fr do not Granger-cause jp ca

data: VAR object msci_jfc.var

F-Test = 22.248, df1 = 4, df2 = 4143, p-value < 2.2e-16

$Instant

H0: No instantaneous causality between: fr and jp ca

data: VAR object msci_jfc.var

Chi-squared = 338.02, df = 2, p-value < 2.2e-16

p<2.2e-16でありフランスから日本、カナダへのGranger因果性が存在する。

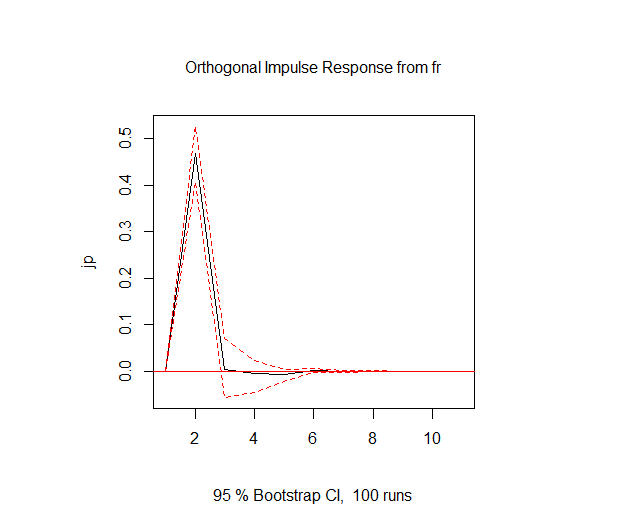

- (6)

msci_jfc.irf<-irf(msci_jfc.var,impulse="fr", response="jp", ci=0.95)

plot(msci_jfc.irf)

フランスにおける1標準偏差のショックは、1日後日本に0.45%程度のショックを与えるが2日以降ほぼショックはなくなる。

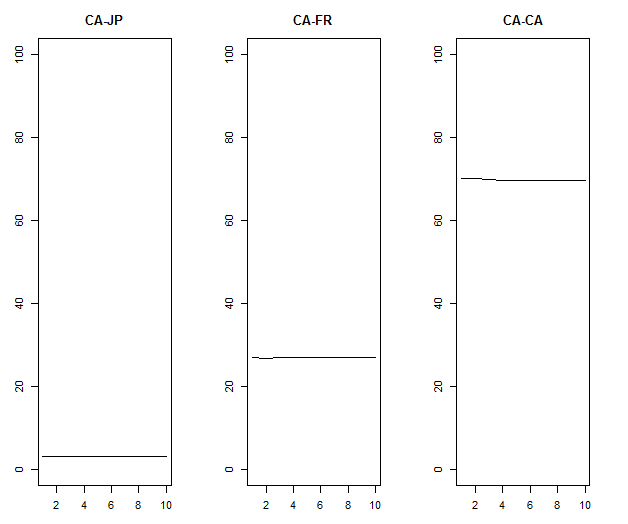

- (7)

msci_jfc.fevd<-fevd(msci_jfc.var)

par(mfrow=c(1,3))

plot(msci_jfc.fevd$ca[,1]*100,type="l",ylim=c(0,100),ylab="",main="CA-JP")

plot(msci_jfc.fevd$ca[,2]*100,type="l",ylim=c(0,100),ylab="",main="CA-FR")

plot(msci_jfc.fevd$ca[,3]*100,type="l",ylim=c(0,100),ylab="",main="CA-CA")

分散分析の結果は予測期間にほぼ依存しない。

予期できないカナダ市場の変動については日本市場が5%、フランス市場25%の説明力を持ち、70%はカナダ市場独自の要因で説明される。